Where travel agents earn, learn and save!

News / Air travel: vaccinations and confidence the key to recovery

Passenger confidence in travel is returning, in step with vaccine rollouts

Confidence is everything, especially in the recovery phase of a pandemic. Where confidence is returning, so are traveller bookings – and such confidence seems highly correlated to areas that have a combination of (a) an effective vaccine rollout and (b) (predictably) low restrictions or barriers to travel.

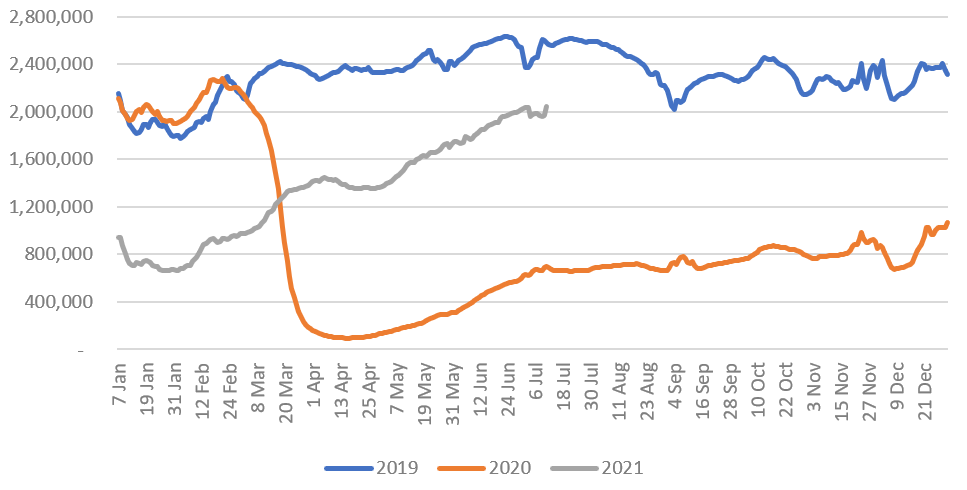

The US domestic market is one such location. Air passenger volumes in the US are now down just 20% on 2019 levels, having crossed the important 2-million-per-day threshold in last month continuing the strong momentum since May 2021.

But yields in most cases remain substantially lower than 2019 levels, although they are trending upwards. A key indicator will be once the traditional business travel season returns in the US in September 2021.

US domestic travel recovery is leading the way

US domestic leisure travel is on a clear recovery trajectory – although business travel’s recovery is much more muted. The test in that market will be when business recommences in earnest once summer holidays are over and people return to working from the office.

US daily passenger numbers: 7 Day moving average pax 2019 vs 2020/21

And the overall summer outlook, from a Covid-19 perspective, is reasonably benign. The IHME’s latest US Covid-19 projection sees a flattening in the mortality rate through the coming quarter (although a worst case scenario projects another 60,000 fatalities).

There will inevitably be a seasonal winter wave, and the question remains as to how bad that will be relative to last year. Hopefully, widespread vaccinations will keep mortality rates relatively low and Americans can continue in their recent patterns of activity.

Low yields remain a challenge as recovery advances

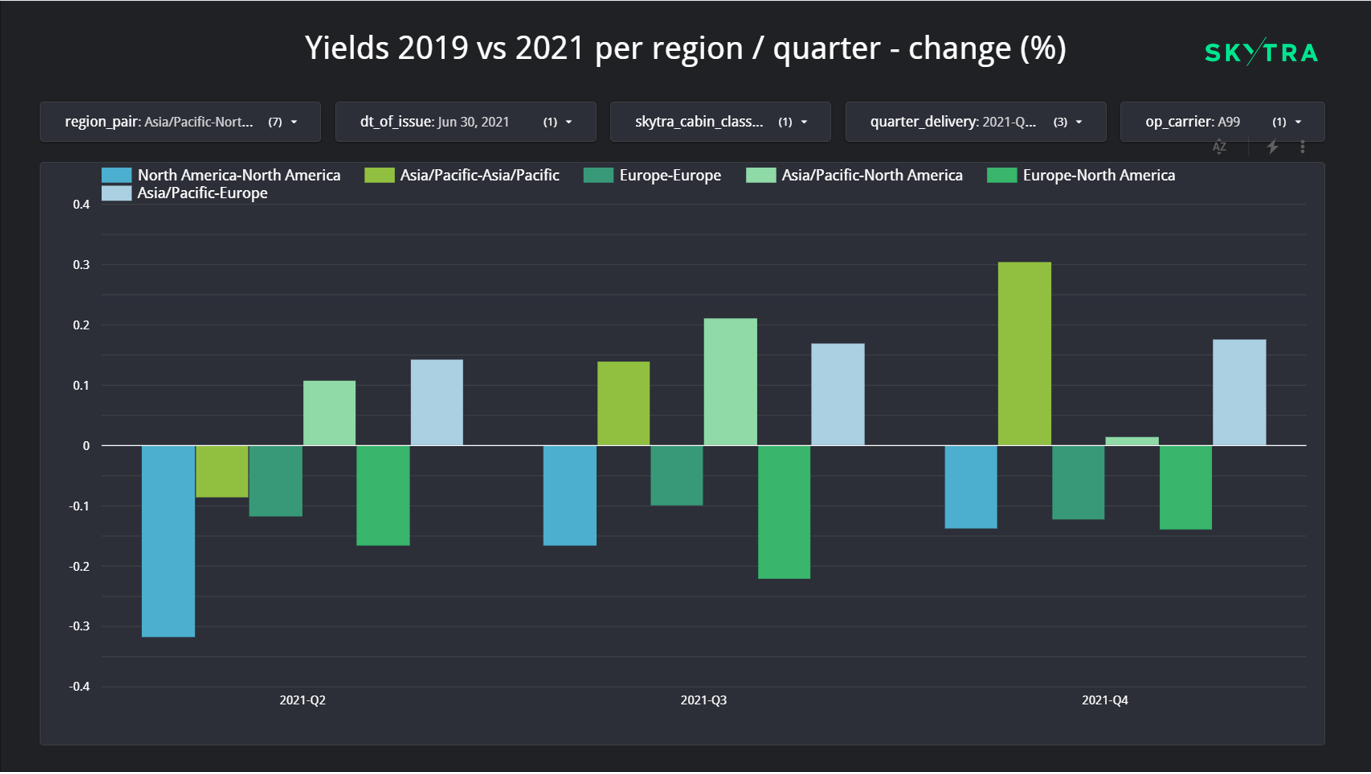

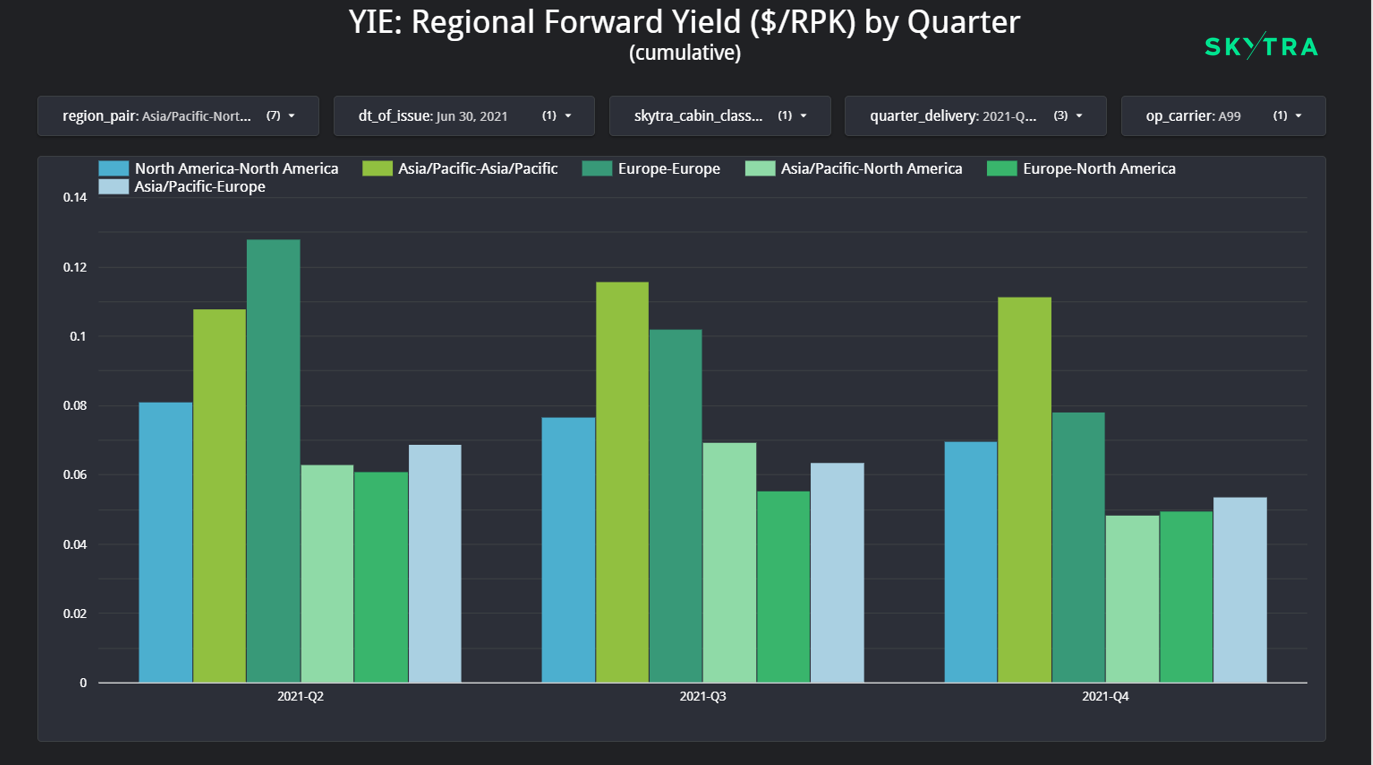

Economy class yields in the domestic-US dominated intra-North American region have been eye-wateringly low, according to Airbus subsidiary, Skytra, which aggregates bookings from a comprehensive variety of sources.

2Q 2021 yields were a startling 32% below pre-pandemic (2Q 2019) levels, reflecting a low yield strategy by airlines to stimulate demand.

Lower yield levels are evident for flights in Q3 (-17%) and Q4 (-14%) this year, and combined with an advanced vaccination program, seems to bring a positive outlook as bookings are going up.

This leads to a strong recovery trend of revenues predicted at: Q3 -37% and Q4 -15% compared to pre-pandemic levels, something that “will lend comfort to the north American carriers”, according to Skytra.

Skytra 2019 airline yields compared with 2021, by region

The North Atlantic summer season is missed for this year

Strenuous attempts are now being made to reopen the very valuable North Atlantic market, US to Europe, and Canada to Europe. But President Biden has rejected calls to open the border to European while cases remain dangerously high in Europe.

For now, the Atlantic is a world of pain for airlines. Where travel is possible, mostly outbound from the US, economy yields in the usually bumper third quarter for Europe-North America markets are down by 22% on pre-pandemic levels.

Vaccination levels are higher in these regions than other parts of the world, so it should be possible to consider much more effective reopening. The North Atlantic will probably reopen faster than other large international markets, although beyond-feed, sixth freedom traffic, on which Europe’s hub carriers rely, will not be there as strongly as previously, hurting operating economics for network airlines.

The North Atlantic market recovery will contain a higher level of narrowbody point-to-point

Likely to add progressively to that pain will be increased narrow-body operations for point-to-point operations across the North Atlantic, both by new entrants and by established airlines with new fleets and lower costs.

According to Skytra, Europe-North America economy yields should improve in 4Q2022, to be down around 14% on pre-pandemic levels.

Intra-Europe and Asia yields remain mixed, as markets gradually reopen

Within Europe, times are still challenging as the airlines’ efforts to lower the yields to stimulate demand does not have a meaningful impact yet.

While vaccine roll-out has progressed more rapidly recently, and will be helped by the EU's Digital Covid Certificate ("Green Pass"), changing rules around entry-requirements are inhibiting booking behaviour into the final quarter.

A slight booking uptick was observed over past weeks for summer travel (Q3) leading to revenues slightly better for the summer: Q2 -77%, Q3 -57% and Q4 -65%. The outlook for 4Q is remains subdued in Europe with an expected 12% reduction in yields compared to pre-pandemic levels.

Skytra forward yields by quarter

Asia Pacific’s limited reopening delivers diverse yields

Within Asia-Pacific, a much larger and more diverse region than Europe, Skytra has observed airlines pursuing a “high yield strategy for future travel with yields exceeding pre-pandemic levels +14% Q3 and +31% Q4.”

Across the region overall, bookings however remain still low with some exceptions for the China domestic market. Airlines are being kept alive by cargo volumes in Asia, and the very limited passenger capacity - well below demand levels, thanks to border restrictions - is priced high, to help contribute to operating revenue on the air services that exist. Asia is also a very diverse region in its levels of vaccine roll-out, led by Singapore, China and Japan.

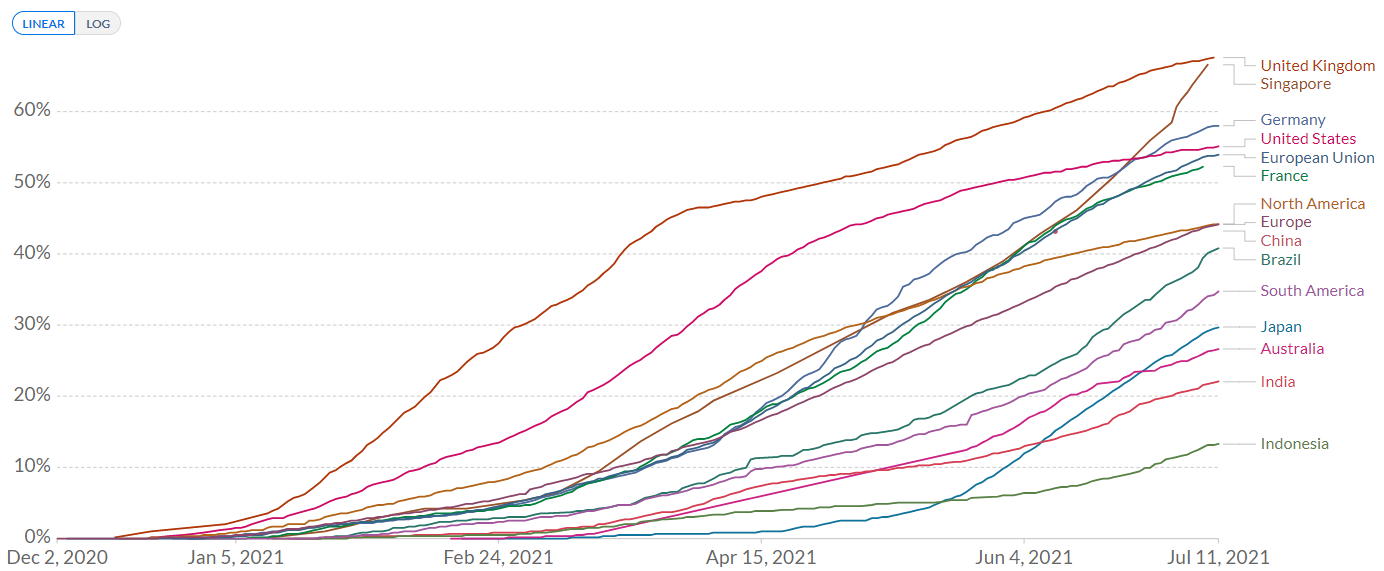

Western countries are much more widely vaccinated

Share of people who received at least one dose of COVID-19 vaccine

Given its generally lower vaccination rates Asia will be much slower to operate more openly, other than perhaps through some of the bilateral bubbles that are being attempted. “Combined with the travel habits of booking more last minute, bookings are still very low” – and are likely to remain so for the foreseeable future.

Vaccinations are key to delivering the confidence factor

Even despite the voracious appetite of the Delta variant of COVID-19, it is clear from behaviour in the US and the European countries which have higher vaccination rates that there is a strong correlation with confidence levels.

This applies both to the willingness of governments to open borders (in both inbound and outbound directions) and to traveller willingness to get back on board. Nonetheless it is clear that there is a long way to go. With the exception of the near-closed Asia Pacific markets, average yields remain well below 2019 levels.

This may be partly due to the absence of higher yielding business traffic, although the same phenomenon applies to Europe’s large LCCs. A critical indicator of future directions will be once US businesses return in earnest in September 2021.