Where travel agents earn, learn and save!

News / US hotels sell nearly 75% of rooms over holiday weekend

Weekly increases in occupancy, rates, revenue show strength of leisure travel

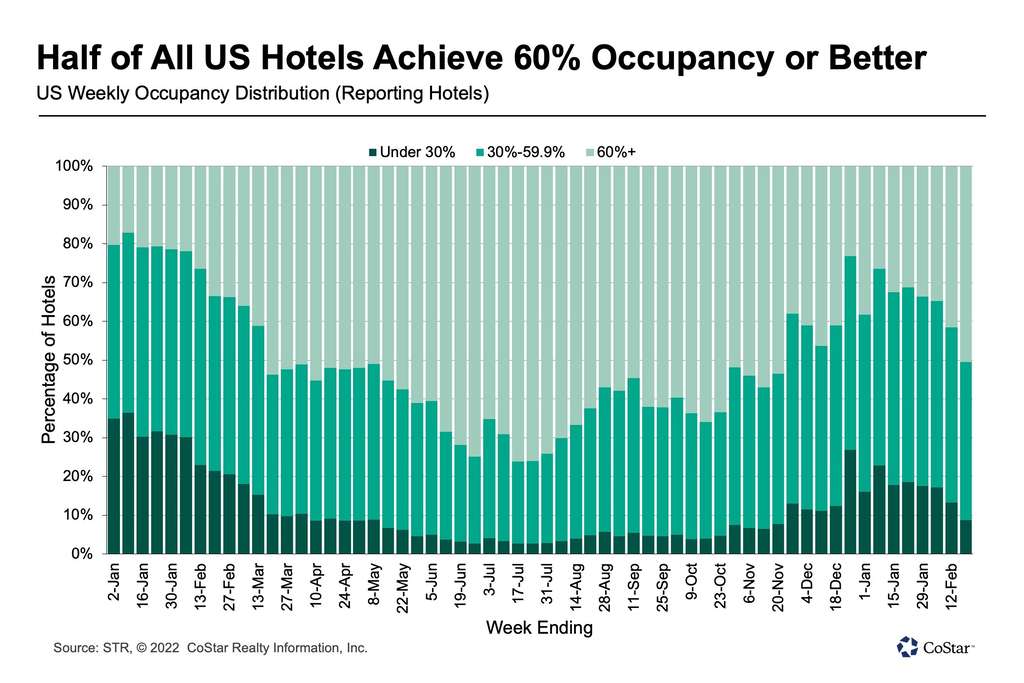

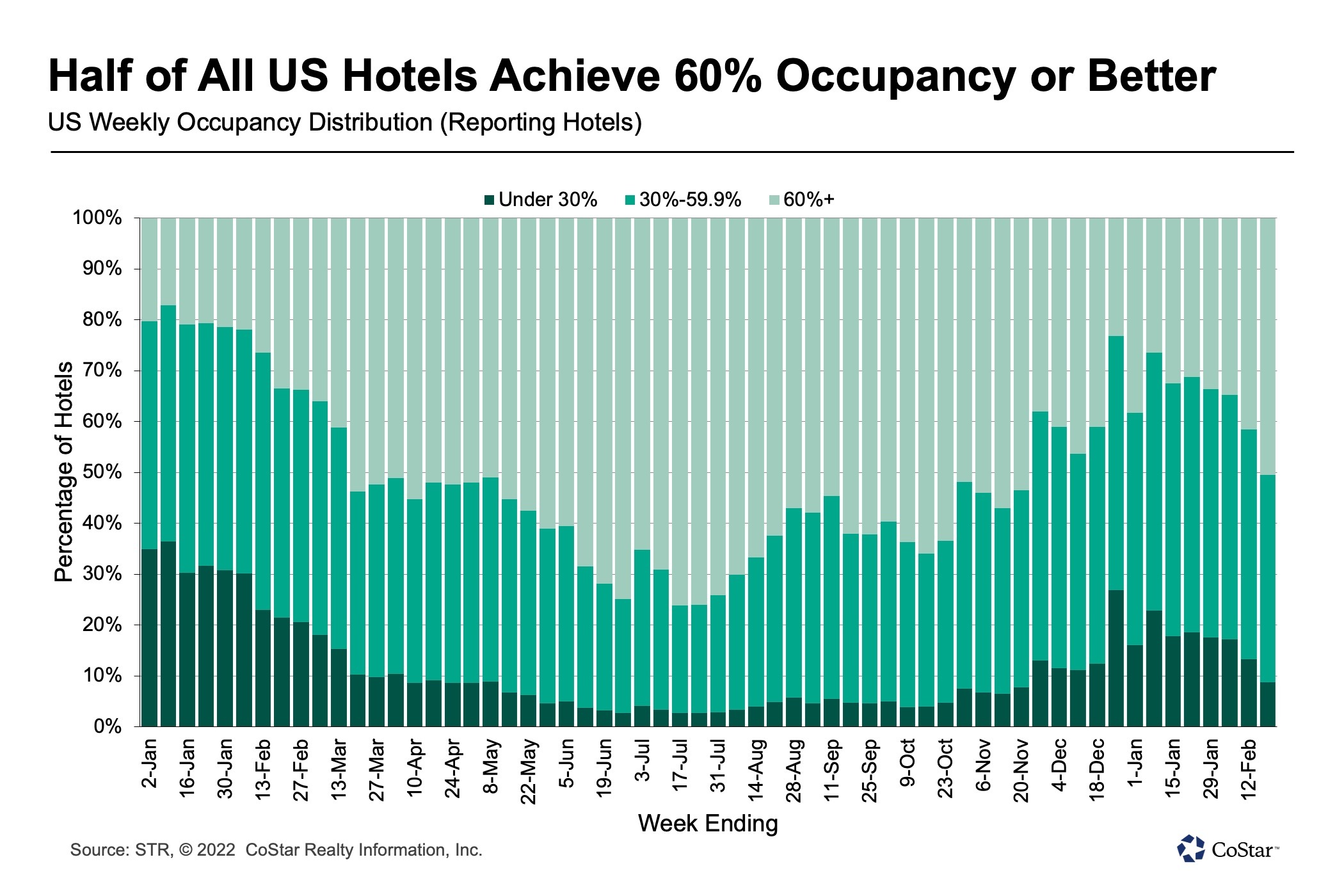

Nearly two-thirds of all hotel rooms across the U.S. hotel industry were occupied over the Presidents Day holiday weekend, marking the highest weekend occupancy since mid-October.

Weekend hotel occupancy exceeded 70% in more than half of the 166 U.S. hotel markets, which helped to boost total occupancy for the full week ending February 19 to 59.1% — the highest level in 13 weeks, according to data from CoStar hospitality analytics firm STR.

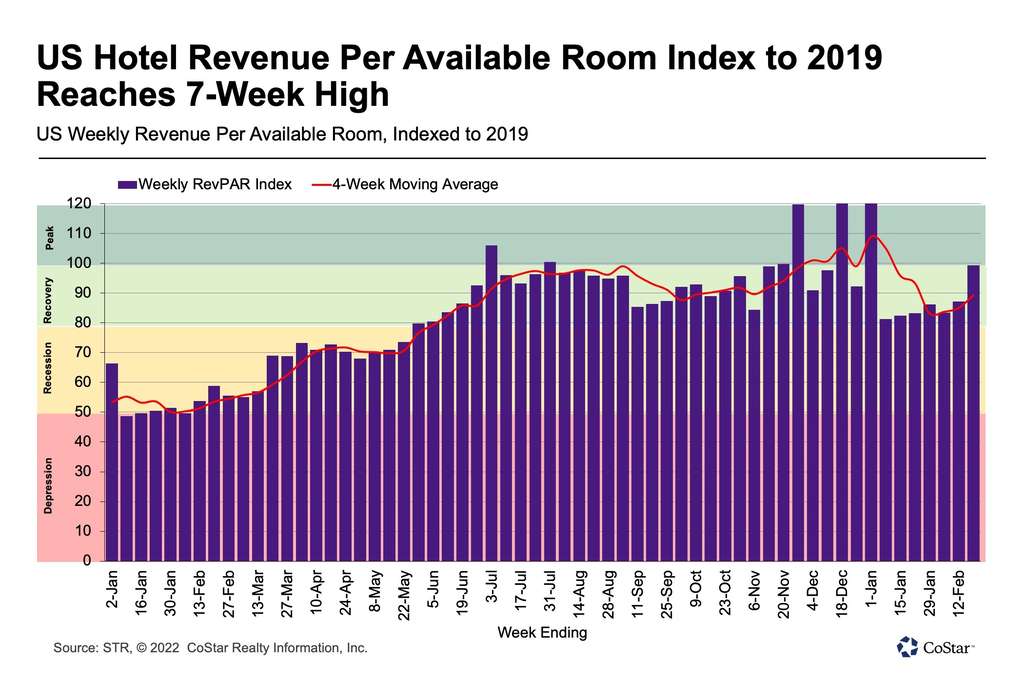

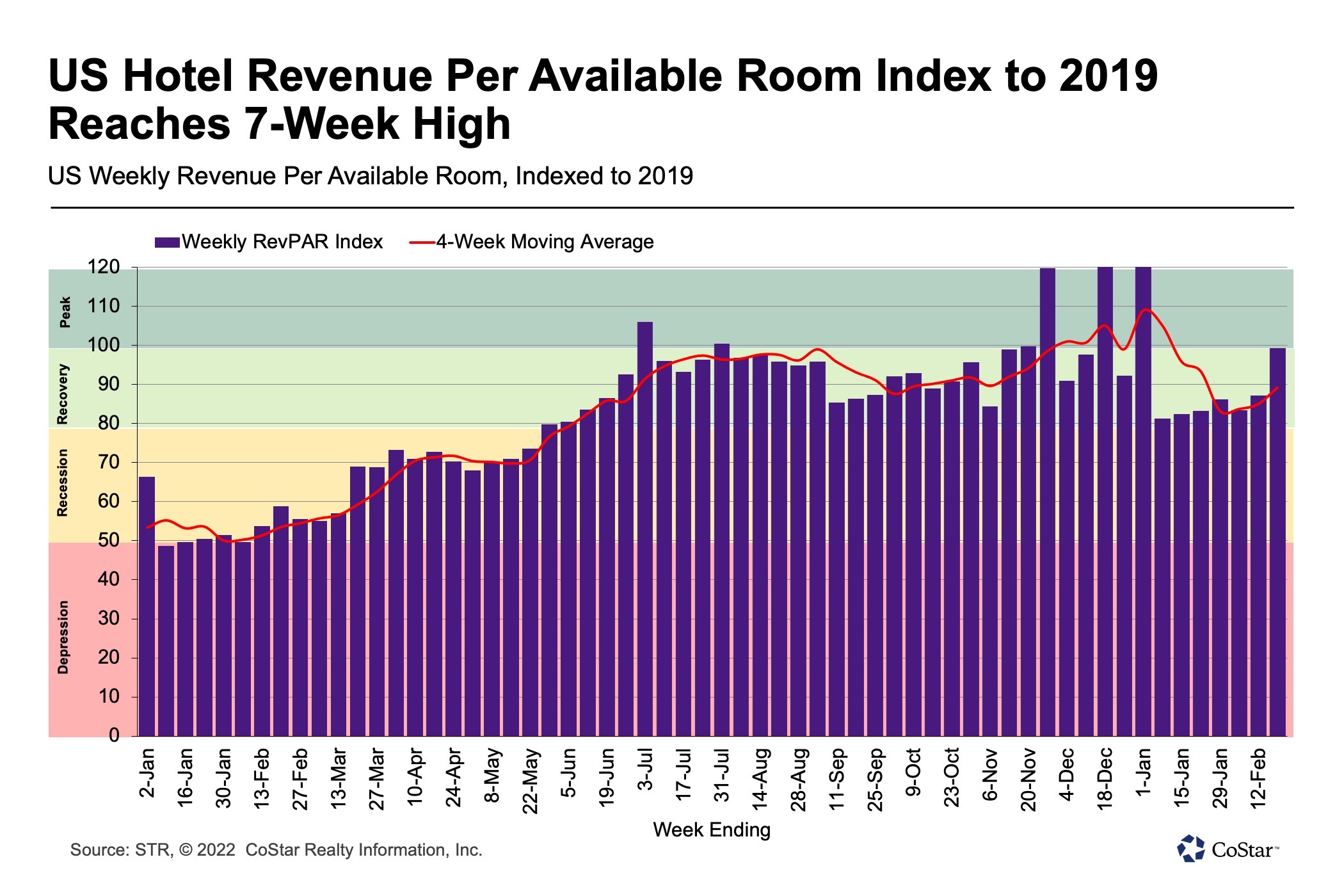

Source: STR

It was the second straight week in which weekly occupancy increased by more than four percentage points over the previous week.

U.S. hotel industry average daily rate also increased 4.7% week over week, which combined with the higher occupancy, resulted in a 13.5% boost to revenue per available room.

Source: STR

Excluding the Christmas holiday week, weekly RevPAR achieved a 17-week high at $83. More than half of all markets were at “peak” RevPAR, exceeding the levels achieved over the same week in 2019. Another 36% of markets were in “recovery,” with RevPAR between 80% and 100% of 2019.

At $116, weekend RevPAR was at its highest since mid-October, even surpassing the Christmas holiday week.

Source: STR

According to historical data from STR, it was the eighth-best U.S. hotel performance over the Presidents Day weekend — specifically Friday and Saturday. Six of the seven holiday weekends that performed better also included Valentine’s Day, with the high point in 2015 when weekend occupancy reached 77.6%. However, hotels over Presidents Day weekend sold 405,600 more rooms in 2022 than in 2015.

The weekly performance clearly showed the strength of leisure travel, which is expected to strengthen even more as spring break travel season starts in the U.S. in the coming weeks.

Additionally, TSA airport security screenings are rising, after bottoming out in mid-January. Some of the increase in air travel is likely due to increasing business travel, which has been evident in weekday demand among the top 25 U.S. markets.Market Highlights

Fifteen U.S. hotel markets achieved weekend occupancy above 90%, led by Daytona Beach at 95.9% and followed by six other Florida markets. Daytona Beach and the surrounding area benefited from the annual Daytona 500 race that coincided with the Presidents Day holiday weekend.

In Orlando, which is the second-largest market in the U.S. based on hotel supply behind Las Vegas, hotel occupancy surpassed 93% — the highest level since Valentine’s Day weekend in 2020.

Nine other markets, mostly in Florida and including Miami at 93.7%, also reported pandemic-era highs in occupancy over the weekend.

In Los Angeles, weekend occupancy was 85%, which was higher than during its Super Bowl weekend, when it was 83%.

Overall, only 15 markets reported occupancy below 60% this past weekend.

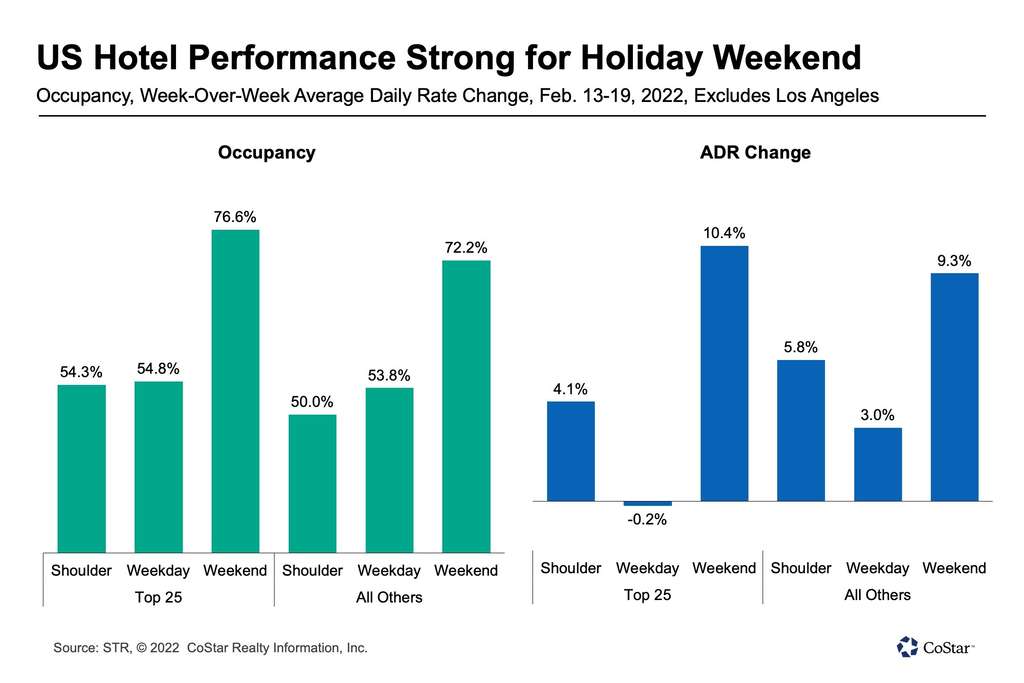

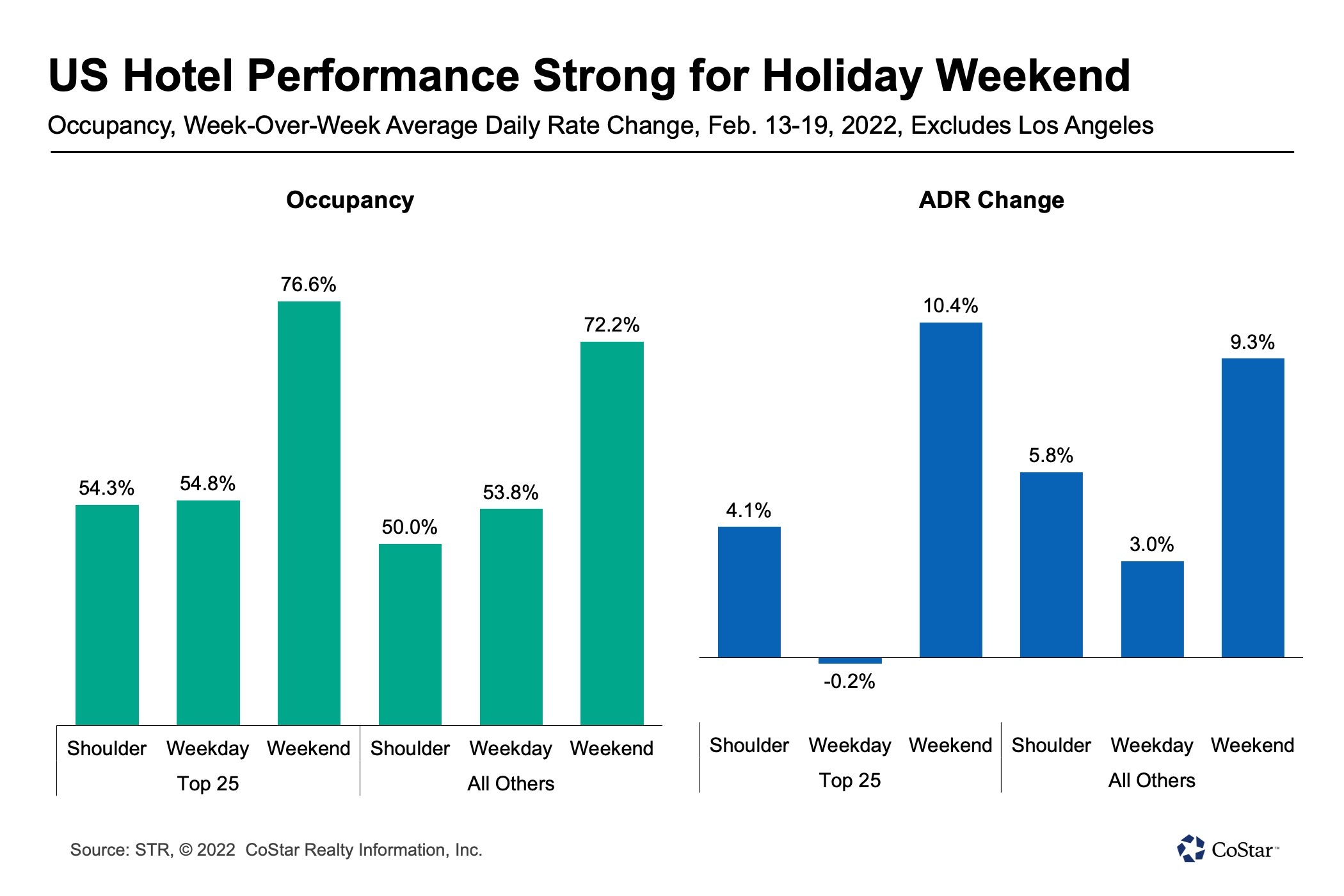

Weekday occupancy, specifically Monday to Wednesday, rose for a fourth consecutive week, reaching 54% — a level last achieved during the Christmas holidays.

In the top 25 markets, weekday occupancy was a bit stronger at 55%, led by Tampa at 77.6% and followed by Miami at 77%. Phoenix and Oahu Island hotels also reported weekday occupancy above 70%. New York weekday occupancy grew for a second straight week to 51%.

Among submarkets identified as central business districts, weekday occupancy was 46.5%, up five percentage points from the previous week. This result was weighed down by six markets where occupancy was 35% or less, including in Chicago, Houston, Philadelphia and Washington, D.C.

ADR for the week was 8% higher than what it was in 2019. This is the second week since the Christmas holidays in which ADR surpassed 2019 levels. Adjusted for inflation, ADR was 3% lower than what it was in 2019.

Weekend ADR was much stronger, surpassing 2019 levels by 25%, or by 13% adjusted for inflation.

Twenty-six markets reported weekend ADR above $200, led by the Florida Keys at $740 and followed by Maui at $639. Weekend ADR surpassed 2019 levels in 97% of all markets, or in 82% of all markets when adjusted for inflation.

Excluding Los Angeles due to the Super Bowl in the previous weekend, weekend ADR in the top 25 markets increased by 10% over the previous week. Eight top 25 markets reported double-digit ADR growth over the weekend, led by Miami — up 36% — and Orlando, which was up 21%. Only Los Angeles, Orange County, and Houston hotel markets reported a decrease in ADR over the weekend.

The highest weekend RevPAR was reported in the Florida Keys where it surpassed $702, followed by Maui at $513 and Miami at $459.