Where travel agents earn, learn and save!

News / Key learnings for APAC travel and tourism sector

Few risk-taking destinations are daring to try some new approaches to compensate for the collateral loss of international arrivals

The APAC region has gone from being a top dog in the travel and tourism sector to being put in the doghouse due to the handling of the pandemic, see-saw Covid19 case numbers and at times, complacency. However, a few risk-taking destinations are daring to try some new approaches to compensate for the collateral loss of international arrivals.

That is why after recently presenting at the Asian Leadership Conference in Seoul, South Korea with a slide deck of 50 ground-breaking data nuggets, ForwardKeys thought to share a few highlights to demonstrate that there are still a few things their travel partners in the Far East can do to keep a steady trickle of tourism dollars until the promised full recovery in 2024.

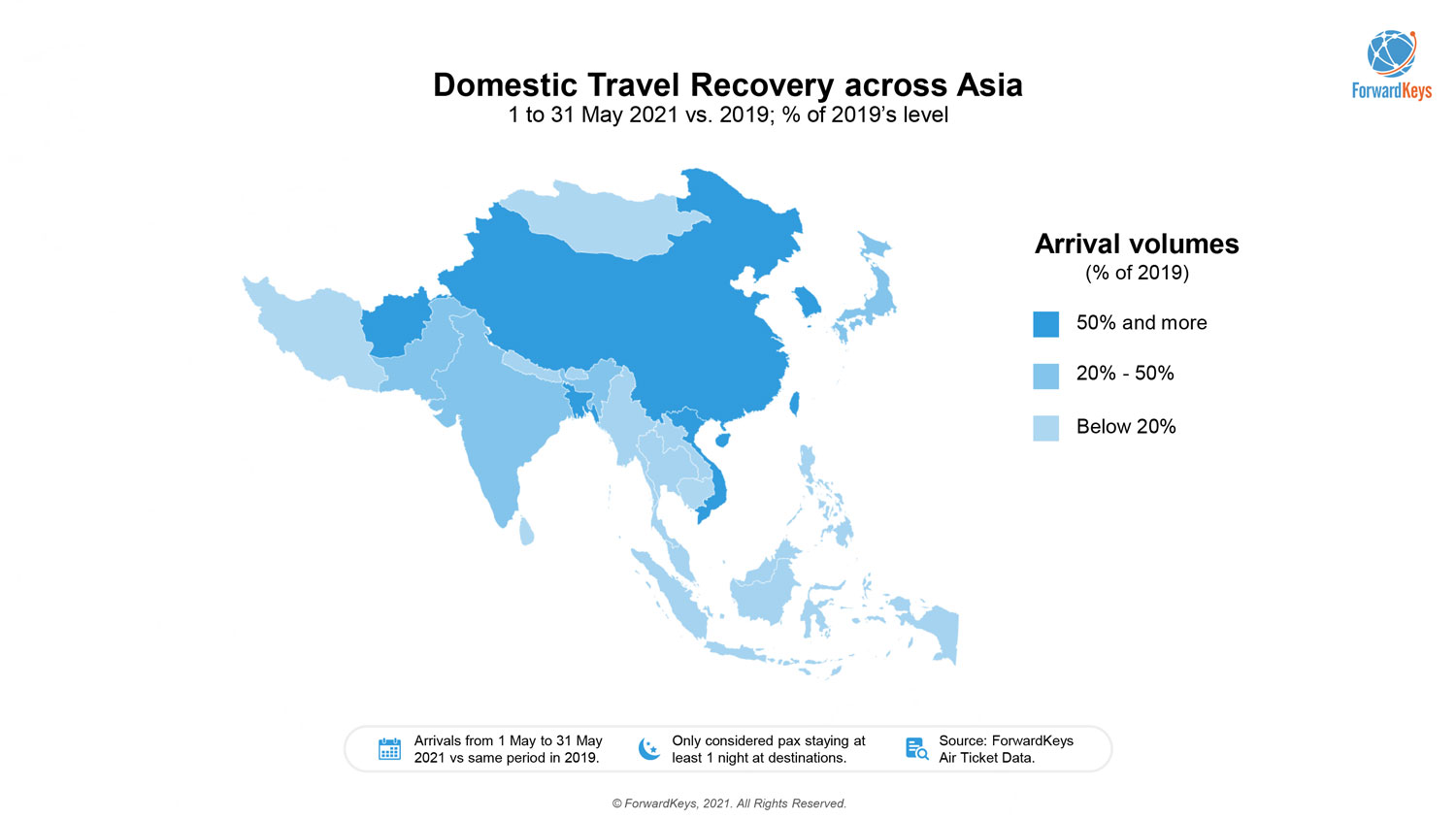

1. Seize the new opportunities in your domestic market

Investing in a sound domestic tourism plan with healthy airline promotions and tour operators in sync has its merits, just ask China.

China reached pre-pandemic domestic arrival levels as early as September 2020, even with the pandemic in flagrant, thanks to teaming up its national public holidays with airline deals for couples (two for one offers) and the introduction of tax-free perks for shopping holidays to Hainan.

With international travel still on hold, the latest revenge travel is taking mainland Chinese travellers to the glitz and glamour of Macau. In the first week of June, issued tickets for travel from mainland China to Macau reached 48% of 2019’s level, while in general, outbound Chinese travel recovered only 4%.

In the post-pandemic era, digitalization has become key to recovery in Macau. The Macau government cooperated with a lifestyle service review and reservation App in mainland China to issue subsidies of about MOP 5 million to local small and medium-sized merchants, including restaurants, local souvenirs, and other merchandise.

In combination with the new consumption habits, post-pandemic local merchants have provided contactless services, such as real-time reservations, online reservations and group purchasing, which make it easier to plan the trip before arriving.

2. Re-think destination strategies & flight connectivity: The Maldives, South Korea & Thailand

“The world has changed, like it or not. That means what you once knew is no longer valid and past historical data is not useful,” says Jameson Wong, Director of APAC for Tourism & Hospitality at ForwardKeys.

Take this period as a time for reinvention as the data is pointing out that this is a glaringly obvious thing to do. ForwardKeys can count three clear examples where destinations can still seize new business if they act promptly, backed by data. Let’s examine, Phuket, Jeju Island and the Maldives.

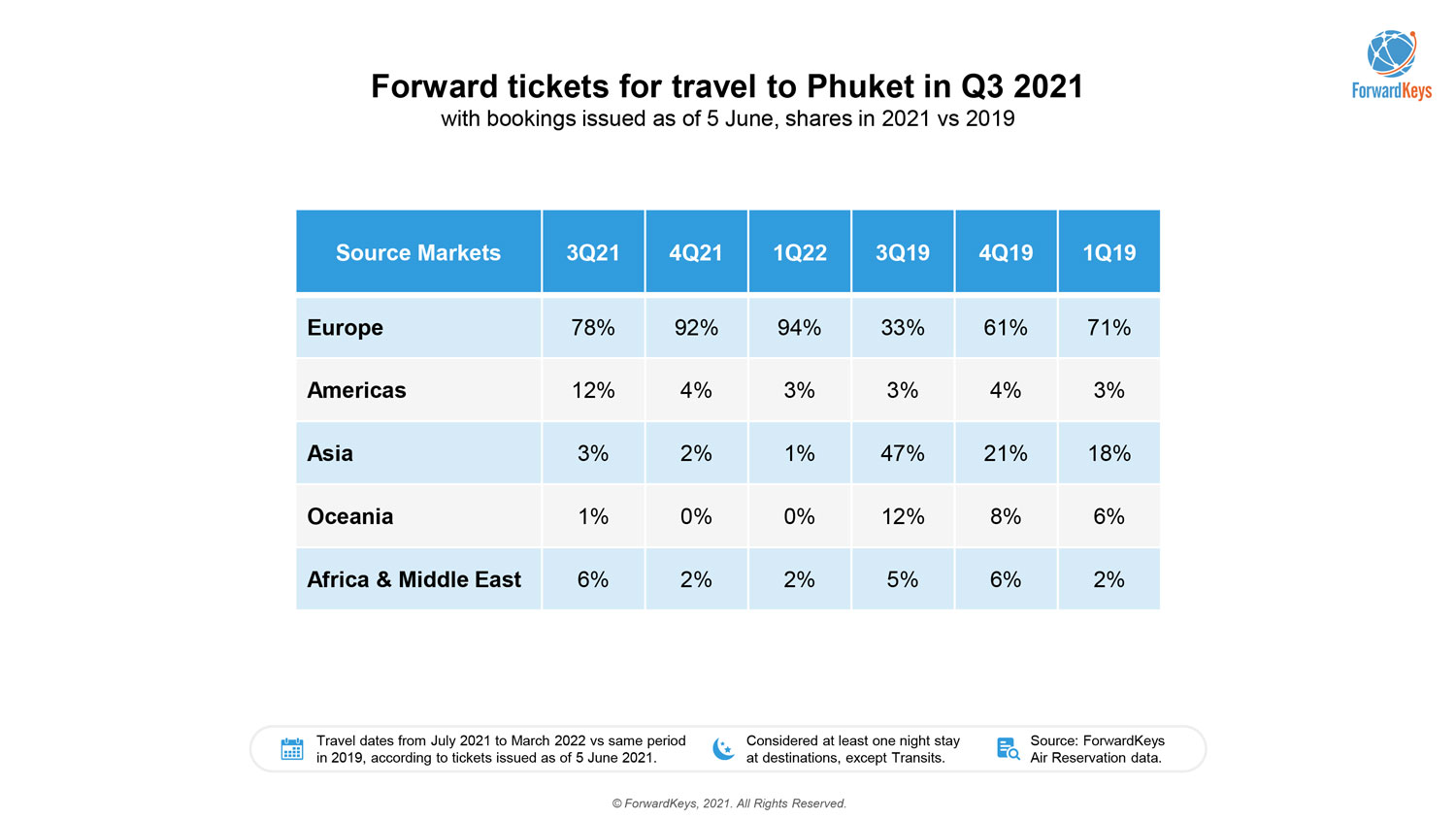

The Phuket Example

What is surprising is the strength of the Israel market this summer in Phuket. For the first time, Israel, a relative newcomer, ties with the UK as the top source for Phuket in July-September, with Germany as the second biggest source. El Al started operating a daily direct flight from Tel Aviv to Phuket on July 1.

“This shows the industry needs to look at other factors, beyond travel restrictions, that will shape travel decisions and change traditional market sources and segments. These factors include airline connectivity, currency and safety perceptions such as anti-Chinese sentiment,” says Wong.

Europe (including Israel) is the dominant source for Phuket this summer, accounting for 78 per cent of issued tickets, followed by Americas at 12 per cent and Africa/Middle East at 6 per cent (see chart). In a reversal, Asia/Oceania is only 4 per cent, a significant drop from 59 per cent in 2019, due to travel restrictions and/or quarantines upon return.

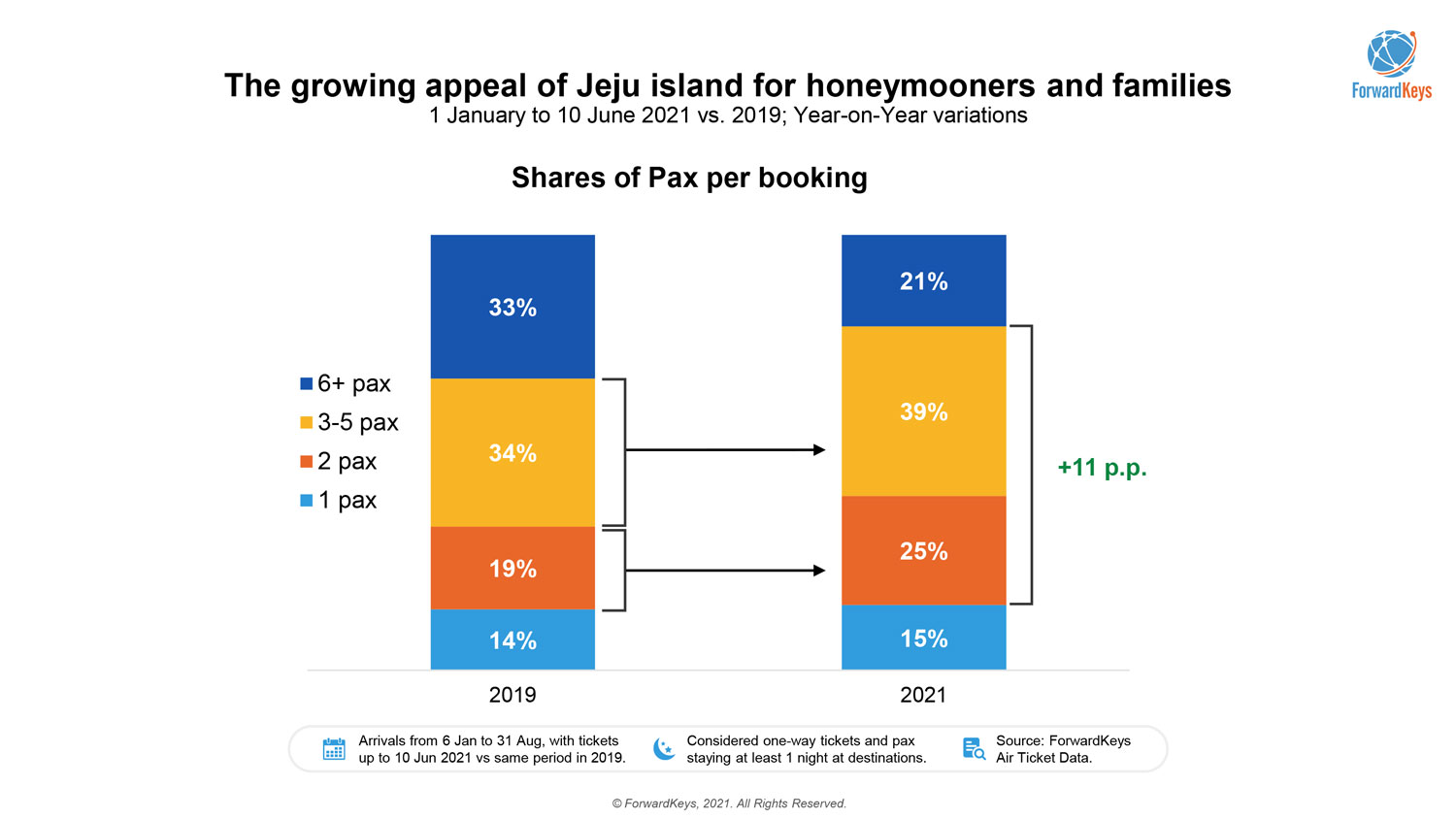

The Jeju Island Example

Here is a fun fact, the flight path between Seoul-Busan is the busiest route in the world (in terms of domestic travel). Not only are the urbanites from South Korea’s capital in a rush to escape to its nearest patch of paradise but the passenger profile has changed too.

Indeed, there has been a growth in passenger shares for those who travel in groups of 3 – 5 aka families. Here is a new business opportunity to seize! Romancing couples are also on the increase – what incentive is your hotel offering?

Seoul’s Incheon Airport has also seen an important shift in its relevance as a regional hub. In 2021 it doubles its share in connecting international travellers, up from 10% in 2019 to 20% in 2021. Neck to neck with Singapore’s Changi Airport.

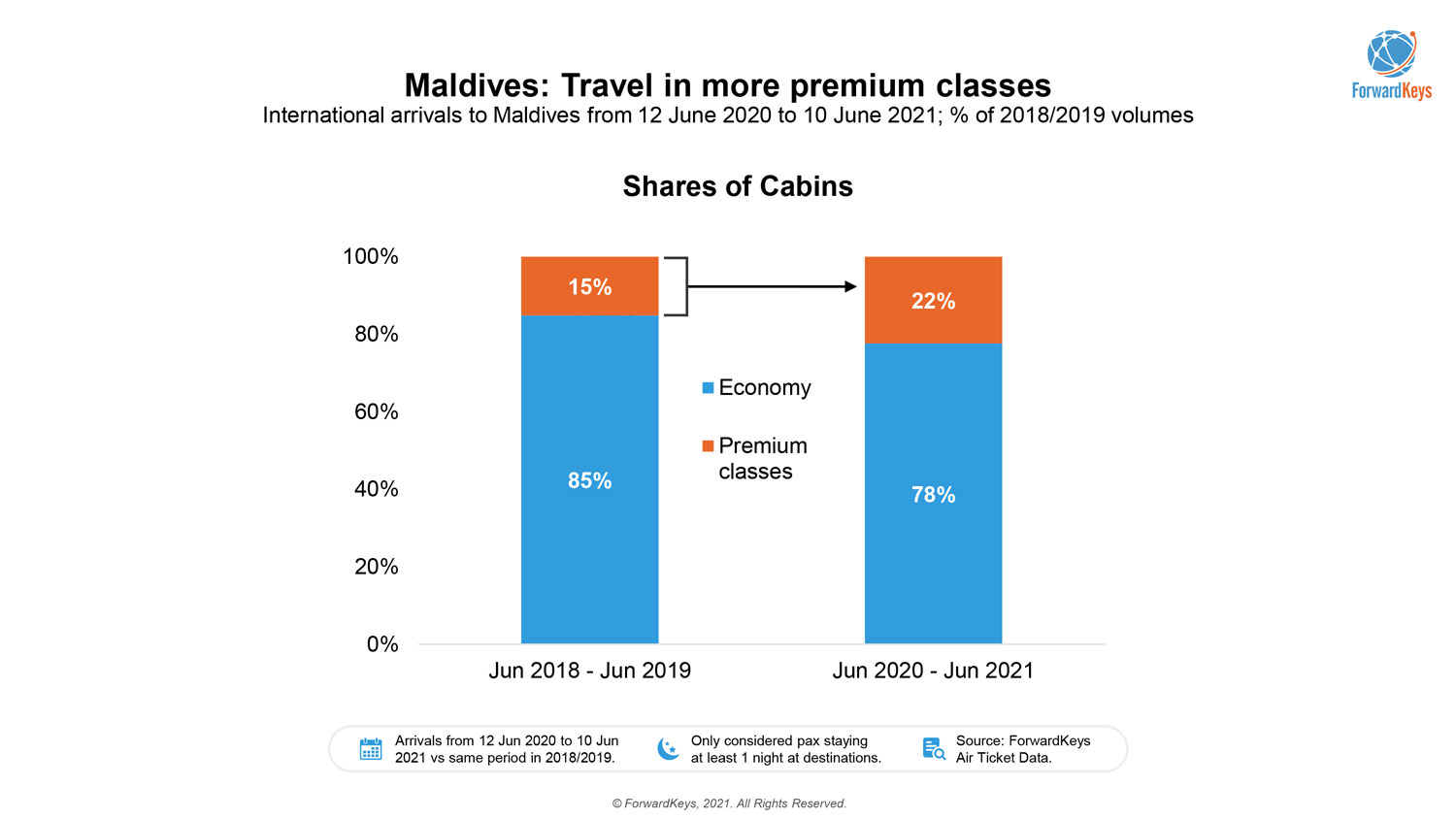

The Maldives Example

The Maldives is demonstrating that acting swiftly and making sage business decisions based on data can make a difference.

“It is with great contentment I note that the Russian market is now the top market in terms of arrivals to the destination since we have reopened our borders in July 2020,” says Mr Thoyyib Mohamed, Managing Director of Visit Maldives.

“Our marketing promotions in the past year has had an impact in increasing the demand for the destination and also the increased connectivity has positively helped the boost in arrivals from Russia,” he adds.

By monitoring new source market opportunities, the tourism board acted swiftly by investing in digital marketing and advertising campaigns in Russia and have capitalized by welcoming not just luxury honeymooners rather affluent families.

Flight connectivity greatly assisted in the Maldives receiving such international travellers via Dubai Airport – which has stayed open throughout the pandemic.

3. Set up “safe” travel bubbles or sandboxes: Trans-Tasman and Phuket

Travel bubbles when announced early, with uncomplicated travel checks and clear safety protocols can work. Two APAC initiatives that merit praise are the Trans-Tasman Air bubble between Australia and New Zealand; and the recent introduction by the Thailand Tourism Authority of the Phuket Sandbox.

“Sure, the Trans-Tasman bubble has had its fair share of hiccups with case numbers rising in W.A first, then Melbourne and Sydney – however, overall, it has seen a steady stream of Australians visiting New Zealand, with most issued tickets coinciding with its Snow Season in July and August,” adds Jameson Wong.

It is the high cases of Covid19 variants, on/off approach to domestic borders and the low vaccination rate of Australia that has delayed the reopening of international borders to possibly 2022 or 2023, a date that has yet to be set.

4. Make early border announcements

One trend ForwardKeys has noticed in Europe that is worthwhile replicating across APAC is clear and early announcements regarding re-opening borders and the applicable travel conditions.

In advance of the popular summer season in Europe, Croatia and Greece announced in Q1 that they will welcome vaccinated international travellers from the US and boom! Guess which source market was suddenly one of their top source markets?

“We even noticed a spike in first-class travel from NYC to Athens for the summer season,” adds Olivier Ponti, VP of Insights.

5. Invent new promotions & activities

Last-Minute bookings have become part of the New Normal. Gone are the days when one year in advance holidaymakers would place a deposit on a trip abroad, it’s impossible to do so!

When examining the ticketing data per each region: APAC, Europe, Africa, the Middle East and the Americas, each region demonstrates the habit of booking closest to departure.

“I think this trend is here to stay,” says Nan Dai, China Market Expert. “In China, we are seeing domestic travel booked under four days and people have adapted to this new habit as the airlines and hotel offers have become more flexible in terms of ticket changes and refunds.”

This trend is tricky for hotels struggling with occupancy rates, but if you know what origin cities your key source markets are, you can improve your marketing spend and enticing offers to suit the relevant audience. For example, Beijing inhabitants are more likely to fly to Sanya while to Haikou 50% of the arrivals are from Chengdu.

People are also staying longer on their trips. Macau used to be a 1 night or 2-day experience for Chinese mainlanders as they paired their holiday with a few days in Hong Kong. Nowadays, Macau is the sole highlight and people are staying on average 3 – 5 nights. What activities and promotions exist to capture this audience and make them return?

Conclusion – Try something different!

This pandemic has shaken up the travel and tourism industry, but like a phoenix rising from the ashes, the desire to travel, explore and meet new cultures is inherent. This is not the end. So, use this time wisely to think, re-invest your energies and let Big Data guide you through this Covid-19 fog.

Travel recovery is starting to show its face in the US, China, and the Middle East – it’s only time before the APAC region is brimming with excited international guests, maybe from new source markets like Israel, Russia and Europe?

ForwardKeys has been assisting tourism organizations and hoteliers with a host of air ticketing data and insights since 2010. From APIs to reports and destination dashboards with real-time data, stay ahead of the curve and contact ForwardKeys.