Where travel agents earn, learn and save!

News / Aircraft seating and inflight wifi; post-pandemic outlook

This report highlights some of the major innovations are under way in Wireless inflight entertainment (IFE), seat amenities and seating products

July 6 - As unprecedented numbers of aircraft sit idle and airline coffers are laid bare by the pandemic, a lifeless and even dull environment for airline inflight product development might be expected.

But the reverse is true. The inflight connectivity (IFC) market is bustling with energy. Changes are afoot also in the way airlines are looking to configure new and existing fleets.

One outstanding trend is the greater focus on premium economy seating, as a reduction in business travel promises to reshape passenger demand and the airline yield profile.

There have been some big moves and new trends emerging, all tracked and made available courtesy of the newest edition to the CAPA Fleet data offering: The CAPA Aircraft Interiors Database.

This short report highlights some of the major innovations are under way in Wireless inflight entertainment (IFE), seat amenities and seating products.

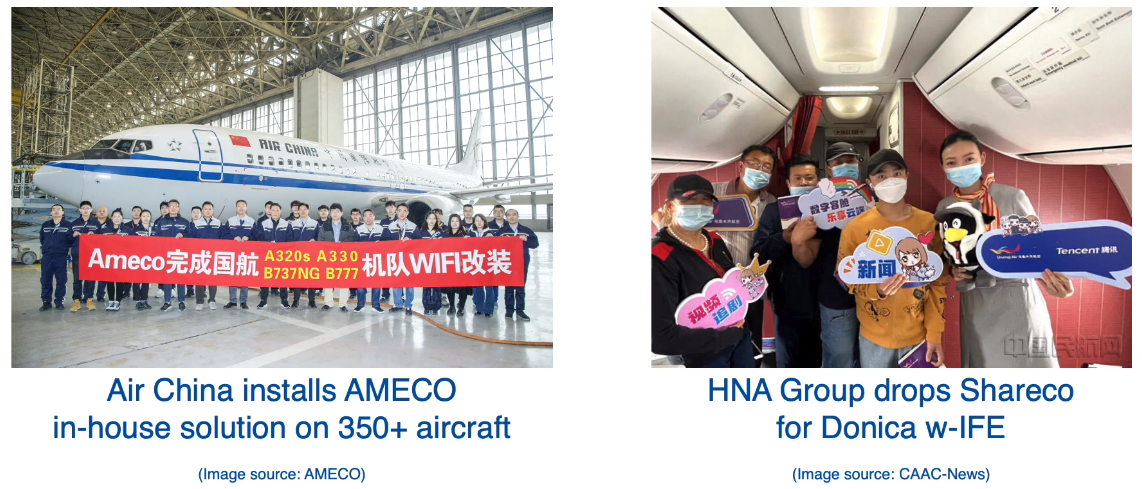

Key Fact #1: Chinese airlines are stepping up to take leading roles innovating with IFE to be more competitive

Many of the major recent developments in inflight product are coming out of China. This has been helped as the Chinese domestic market has been among the least affected domestic markets by the coronavirus pandemic.

After years of all talk and very little action, Chinese airlines are rapidly making major inroads into inflight WiFi.

This has not led to full connectivity, but there are important steps being taken in a trend towards wireless inflight entertainment (IFE):

• Air China recently announced full implementation of an in-house solution from Ameco, the Air China-Lufthansa JV, on its A320, 737, A330, and 777 fleet

• In the meantime, HNA Group airlines are busy rolling out a solution from Shenzen-based Donica, while dropping former vendor ShareCo

• Even China Express Airlines, one of the few regional airlines of China, has 5 CRJs offering a FairLink Century solution, and plans for full-fleet implementation in three years

• Earlier Qingdao Airlines also adopted a home-grown full IFE solution

Chinese airlines had been touting WiFi since the middle of the past decade. But, except for China Eastern introducing a fully connected widebody fleet, other Chinese airlines have either been locked in the “trial” phase or only operated a minor subfleet with internet connectivity or wireless IFC.

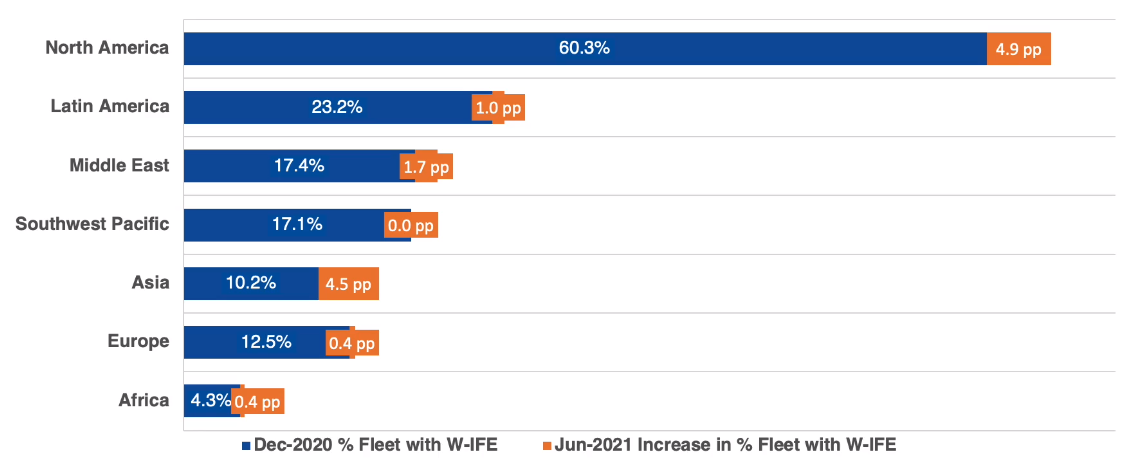

Key Fact #2: North America still leads by a large margin with wireless IFE

The leading region for w-IFE remains North America, with some 60% of the fleet covered – close to a 5ppt increase from the end of 2020, according to the CAPA Aircraft Interiors Database.

Latin America’s airlines come a distant second and Europe, perhaps surprisingly, lags well behind with on 12.5% of its fleet connected in this way. Asia, led by China, is however growing at a faster rate.

Wireless IFE predominance by region: percentage share of installed fleet and ppts change in June 2021 compared to December 2020

Chinese airlines, notably, have some of the highest levels of usage of dropdown screens, even seatback screens, on narrowbody aircraft.

It appears that the push for personalized entertainment and dual screen experience is taking hold in China’s highly competitive marketplace as airlines struggle to differentiate in a much more competitive and experience-oriented landscape.

However, the inroads in w-IFE seem to indicate that Chinese airlines are, in the near term, not interested in connected narrowbodies or are awaiting a cheaper and more reliable solution (such as perhaps ATG 5G).

Key Fact #3: Fresh approaches to inflight connectivity

Globally, some of the major IFC developments include Delta officially embracing a dual-vendor solution with Viasat, in addition to Gogo, and KLM officially starting to offer IFC on narrowbodies, also with Viasat.

KLM’s partner Air France also decided to double down on the multi-vendor approach, tapping Gogo for its upcoming A220s.

Earlier this year Wizz Air trialled an innovative Bluetooth connectivity kit. In Japan, Peach became the latest local airline, after regional airline IBEX, to tap its home-grown TEAC wireless IFE solution.

Key Fact #4: Wireless IFE vendors get creative to make inroads during the pandemic

Accelerated announcements are being made in the wireless IFE space, such as from Inflight Dublin and LiFE in the Air, on wireless IFE trials.

Providing trials allows vendors to hook cash-drained airlines so that once demand returns, airlines will immediately sign up to these innovative offerings.

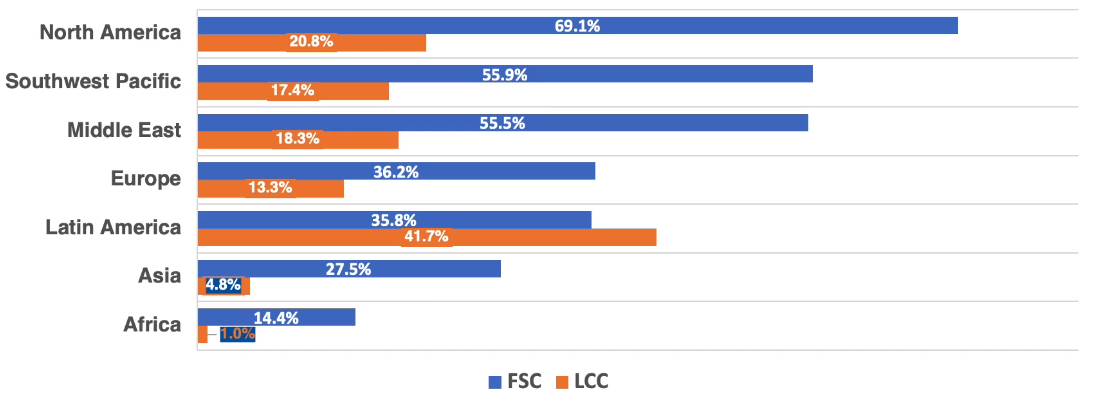

Key Fact #5: LCCs are gradually adding more in-seat amenities

There have been recent cabin revelations from LCCs such as Tigerair Taiwan and Blue Air, marking a general trend that LCCs see the competitive advantages of offering more than ‘just a seat’.

More LCCs now offer in-seat power, often in the form of USB-A ports, and/or device holders, to allow passengers to view content more comfortably on their own devices.

Globally, the share of LCC aircraft offering at least one personal electronic device support amenity is reach significant proportions, transforming the traditional view of LCCs offering only bare-bones services.

Percentage of fleet offering with at least 1 PED-support amenity (A/C, USB, device holder)

Future trends to watch

For obvious reasons there have been few major announcements from airlines on seating and configurations. Many new deliveries have been delayed, leading to the postponed introduction of new products.

But, as airlines look to reorganize fleets to position competitively for the post-pandemic environment, new moves are under way. Retrofits have recently resumed. These can take years to plan and involve millions of dollars of investments, although emergence from pandemic conditions will accelerate the process.

There are also many unknowns regarding the pace and scale of the return of the crucial business travel market. In short, many airlines are unlikely to have the cash flow to respond to new COVID market conditions in major seat/cabin reconfigurations.

But there are trends emerging – some that have been years in the making:

Seating Trend #1: Dual-economy seating products

Something of a half-way house, but one which gives an indication of the way some airlines are anticipating the profile of the post-2021 marketplace is the potential expansion of two types of economy class seating.• Dual Economy-class: KLM recently became the latest airline to embrace a dual-economy class seat model solution, offering a more comfortable product with thicker padding and more recline for the first few rows of Economy; these seats can also be converted to EuroBusiness. The remaining rows use a product with less padding and recline

• TAP Air Portugal was an early adapter of dual-model economy class and recently rolled out a version 2 with the latest pair of Recaro models. This shows how airlines have realized the importance of product differentiation, not just with fare types, but also with the actual hard product

Seating Trend #2: Sub-fleets with a different seating configuration

• A growing focus on Subfleets is another interesting airline trend. Earlier this year, Vistara took delivery of its first factory-fresh single class aircraft. As recently as late May 2021, Sichuan Airlines also took delivery of its first single class aircraft

Both developments signal that airlines are aiming for differentiation and flexibility as they continue navigating uncertainties in the post-pandemic market.

Seating Trend #3: Rise of premium leisure (and lower cost corporate)

Some recent developments in seats offer a glimpse into the potential nature of a post-pandemic airline marketplace.

Delta recently revealed plans to install only Premium Economy on its A330ceos and 767-300ERs, while leaving business class untouched.

Delta appears to be taking a risk-averse approach. As the future of business travel remains uncertain, it is clear that there will be a clear need for a premium leisure market and a low cost corporate travel market.

Premium Economy can potentially offer the perfect middle market solution for this.

Emirates is also doubling down on Premium Economy, announcing plans to install the seat type on its existing A380s, in addition to just the factory-new ones. Swiss, meanwhile, has announced that it will proceed with installing Premium Economy as planned.

Lufthansa also announced earlier in 2021 that it is considering decreasing the number of business class seats to make room for Premium Economy; Japan Airlines made a similar announcement for its A350-1000.

While many airlines airlines are taking a wait-and-see approach for products at both ends of the aircraft, it now seems very clear that the trend towards investment in the “middle”.

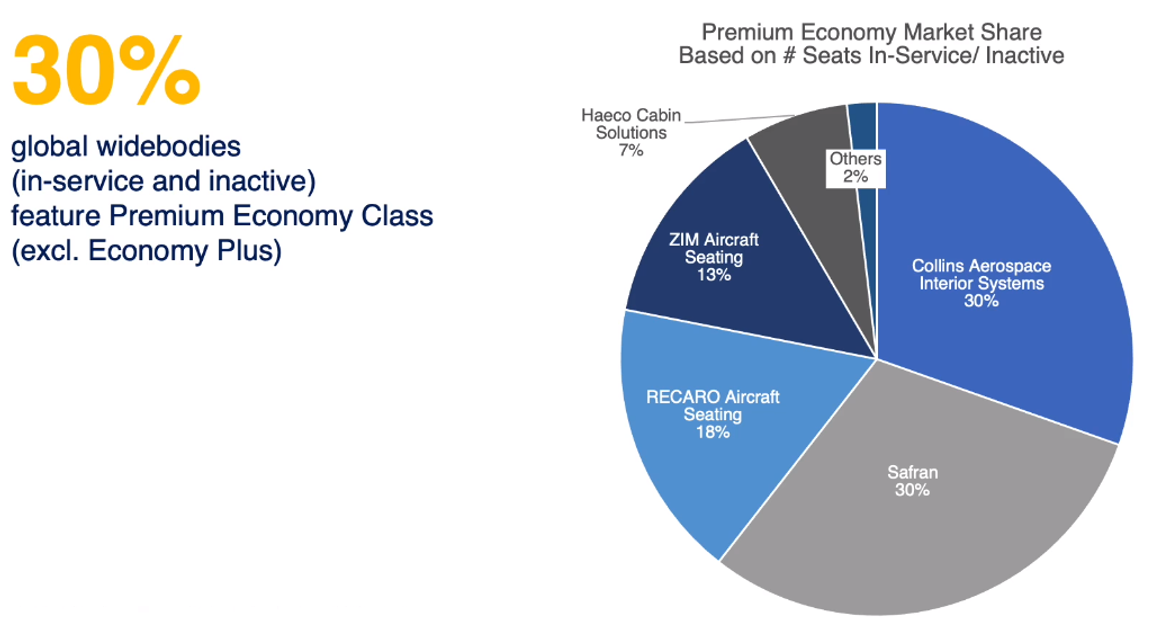

Some 30% of the world’s fleet now has some form of premium economy offer – and this percentage is only set to rise through the pandemic recovery phase.

However if there is a sudden lift in demand, issues like potentially disrupted supply chains and skilled employee shortages may mean delivery delays. New suppliers emerging - and market share changes - can be anticipated.

Four companies dominate the premium economy market, including Collins, Safran, Recaro, and ZIM, should be beneficiaries of this development.

Premium economy market share (percentage), based on total seats (in-service/inactive aircraft)

There are still many unknowns, but the unique CAPA Aircraft Interiors Database removes the complexity

As the industry continues navigating new developments and aims to figure out a clear strategy, CAPA will continue to offer unparalleled insights to minimize unknowns and help the industry craft data-backed strategies.

More Travel News:

Travelport and Emirates reach agreements on un-surcharged content, NDC distribution and it service extension

TourRadar launches new suite of tools to encourage sustainable travel

St. Kitts & Nevis to remain open to international tourists

Vaccines and digital solutions to ease travel restrictions