Where travel agents earn, learn and save!

News / US airports: Seattle attempts to locate site for second airport

Seattle is searching for a second airport to act as a reliever for SEA-TAC International

Few mid-sized US cities have more than one commercial airport competing for business outside the bigger main conurbations (New York, Chicago, Los Angeles etc.).

In some cases the addition of a new one, even as merely a reliever, supporting perhaps only low cost carriers or even freight, might be justified. That has been the debate (a long one already) at Seattle, where six potential sites, five general aviation facilities and one airport already partly developed, are again under consideration.

The partly developed one, which is also managed by a firm specializing in airport PPPs, looks to be the favourite, but political, economic and crucially environmental considerations will also come into play, and there is always a slight possibility that one or more airlines will resist the strategy altogether. As happened at Atlanta, where the developer at the Paine Field site near Seattle was also the intended developer in Georgia.

The ultimate tech city continues its search for a second airport

If any US city apart from San Jose is symbolic of how the United States has become dominated by ‘Big Tech’ it is Seattle, although the country’s northernmost city is also home to a major port and a raft of more traditional industries. And Seattle became North America's first ‘climate neutral’ city in 2010, with a goal of reaching zero net per capita greenhouse gas emissions by 2030.

Technology sector companies include Microsoft, Amazon, Nintendo, T-Mobile and Expedia, while more traditional ones include Starbucks and Costco.

Before it moved its HQ to Chicago, Boeing was headquartered in Seattle and retained its Commercial Airplanes Division there, with a factory at Everett Paine Field Airport, which is a candidate for the region’s second commercial airport. Alaska Airlines’ HQ is also in the city-region.

There has additionally been an influx of established and start-up biotech companies throughout the region and Seattle is a hub for global health organizations, with the headquarters of the Bill & Melinda Gates Foundation, one of 170 such organizations throughout the area.

Accordingly, Seattle is one of the highest salary-paying cities in the US (third in 2021), with the average being USD115, 000.

Unless and until the entire technology sector starts to collapse – anything is possible but not likely – the only way for Seattle is up, and in October 2021 it was reported that Washington State officials were currently in the process of identifying a viable site for the construction of a second major international airport, in order to meet the projected aviation demand in the Puget Sound region by 2050.

A shortlist of two sites is expected to be formulated by September 2022, with an official recommendation to be submitted to the Washington State Legislature by February 2023.

Sites under consideration include:

- Arlington Municipal Airport

- Bremerton National Airport

- Everett Paine Field Airport

- South Lewis County Airport

- Sanderson Field Airport

- Tacoma Narrows Airport

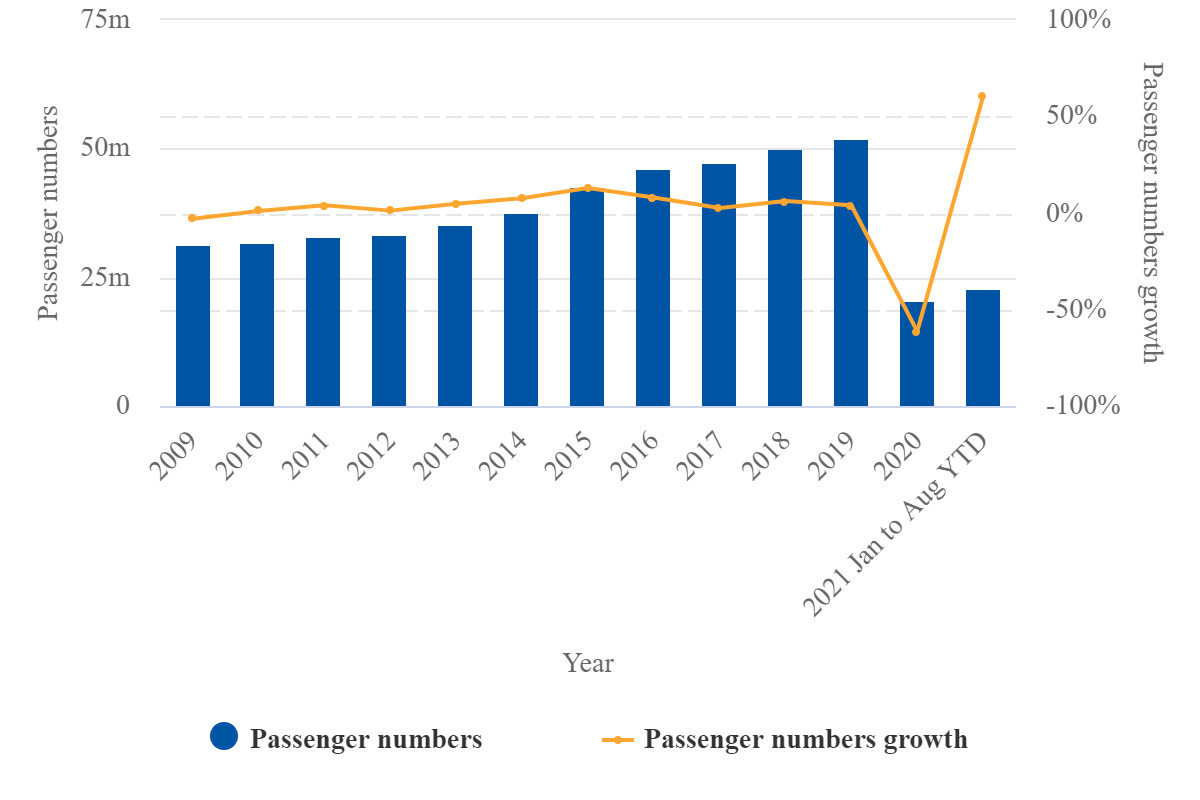

Seattle-Tacoma International Airport: passenger numbers/growth, 2009-2021

Source: CAPA - Centre for Aviation and Seattle-Tacoma International Airport reports

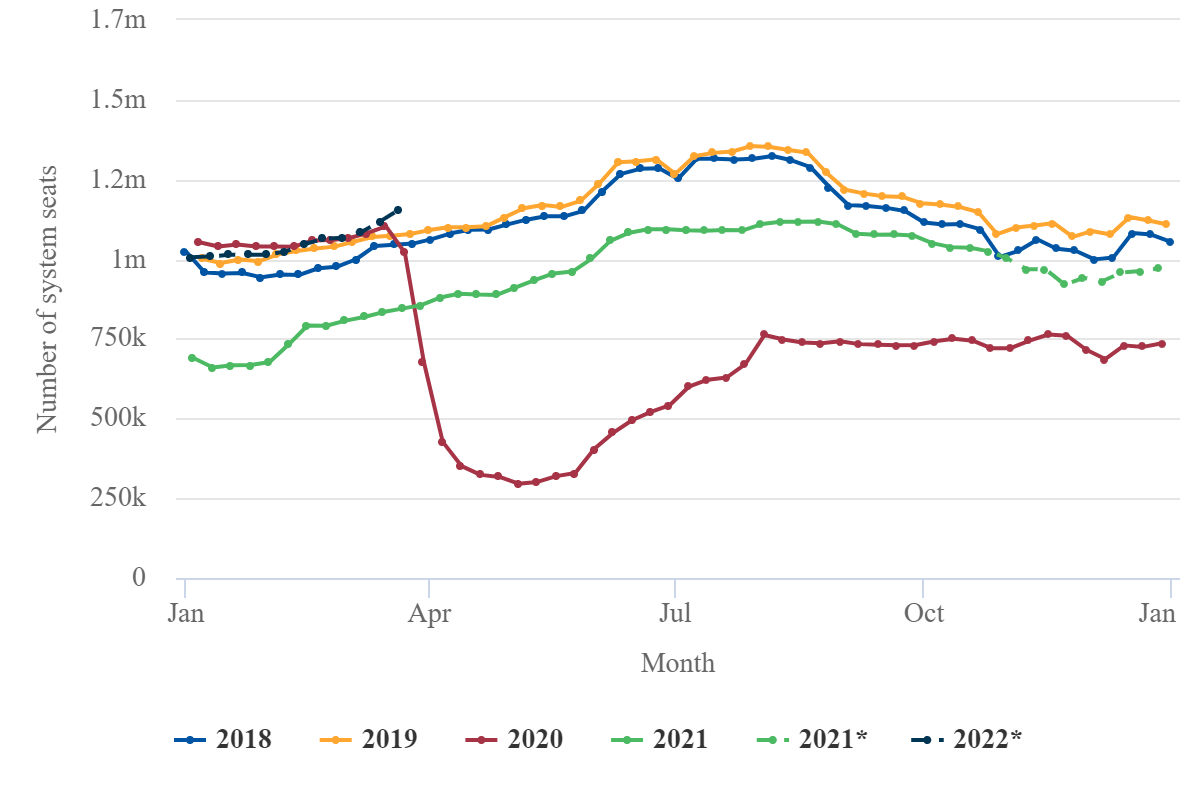

Compared to 2020, there is a noticeable recovery in seat capacity under way.

As of the week commencing October 11, 2021 the capacity gap has narrowed to 89% of the same week in 2019, whereas it was 64.5% at the same point in 2020. The 2021 figure is 5.5 ppts better than the overall US gap.

Seattle-Tacoma International Airport: weekly total system seats capacity, 2018-2022* (projected)

Source: CAPA - Centre for Aviation and OAG

In common with most US airports the majority of capacity (here 93.3%) is domestic, but it should now begin to shift in favour of international again due to regulatory decisions taken recently by the Federal administration.

All the main US airlines are represented, but few foreign airlines have returned yet

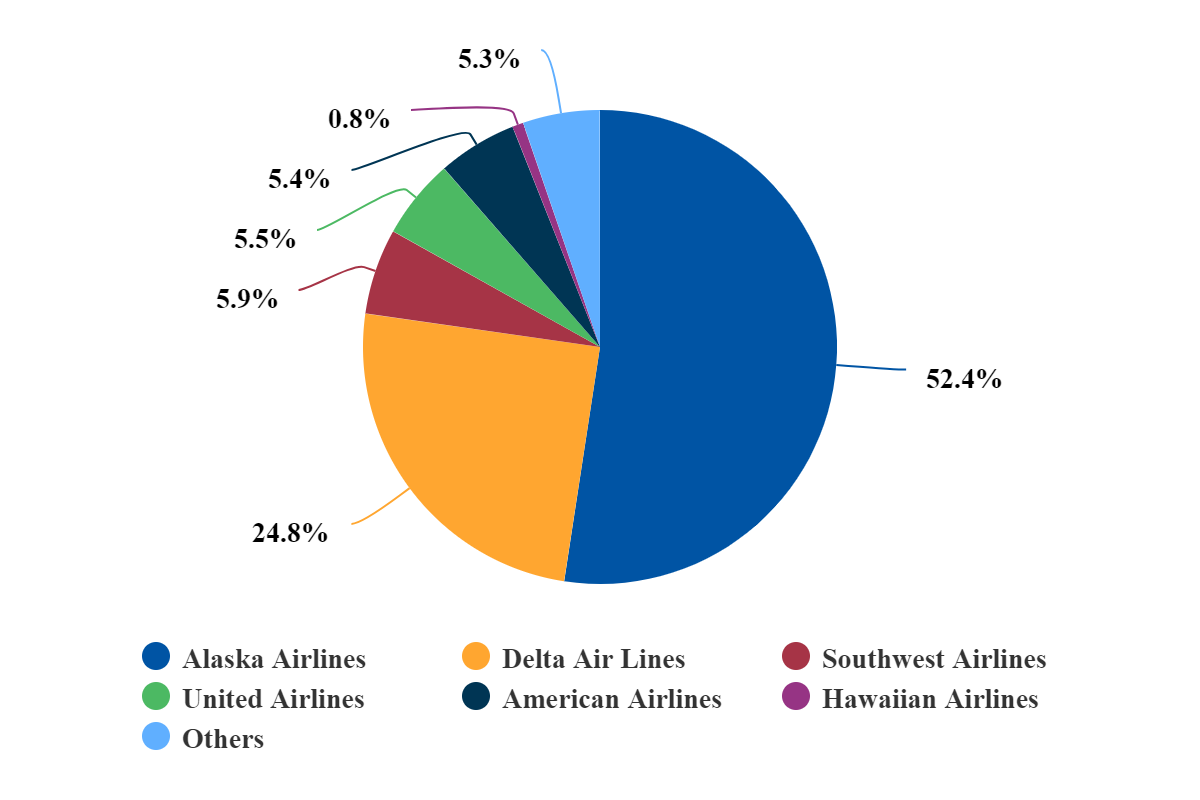

At present, Alaska Airlines has the bulk of the capacity (52.4%) and of movements (59.4%).

However, the ‘Big Four’ US airlines, Delta (which selected Seattle as its West Coast ‘springboard’, prompting Alaska Airlines to respond), Southwest, United and American are all represented, varying between 24.8% (Delta) and 5.4% (American) of capacity.

Seattle-Tacoma International Airport system seats, all business models, week commencing October 11, 2021

Source: CAPA - Centre for Aviation and OAG

But there are few foreign airlines operating there presently. They account for just 3.5% of capacity, and to win them back Seattle is in competition with other cities down the Pacific seaboard, including Portland, San Francisco, Oakland and Los Angeles LAX.

Where there is foreign capacity at all, the two main destinations – as might be expected, and despite tough entry rules in one case – are Canada and Mexico (jointly 50.6%).

Mainly a full service airport

Seattle International (SEA-TAC) Airport is mainly a full service/network carrier-hosting airport, as might be expected given the nature of its commercial clientele (91.9% of seats).

Historically, in the low cost domain where there were opportunities, Seattle has not had much in the way of competition from other airports in the region. And less than 10% of its seats are on ‘unaligned’ airlines, with oneworld the largest alliance (59% seat capacity share).

Fundamentally, it is geared up towards full service operations.

Paine Field has the advantage

What impact does that have on the potential ‘second major airport?’ An early favourite must be Everett Paine Field airport.

Almost three years ago CAPA reported that Paine Field, which existed to serve Boeing’s requirements, would serve as a small-scale experiment as a reliever airport, with Alaska and United working to launch flights from the airport (which is approximately 40km north of Seattle).

Alaska had previously stated that services from Paine Field would make it easier for travellers residing in the Northern Seattle metro area, and the airline envisaged a comprehensive West Coast network. Traffic congestion on Interstate 5 to Seattle Tacoma International from the north makes it challenging for some passengers to reach the airport.

But those plans were hampered by a lack of terminal capacity; Paine could accommodate only 24 departures per day.

Then, at the beginning of 2020 the operator, Propeller Airports, which is a New York-based private equity firm that specialises in public-private partnership investment projects for airports, announced that GIP (Global Infrastructure Partners) had agreed to manage an investment at Paine Field on behalf of the Washington State Investment Board and that environmental objections to the expansion of the airport had been overcome. GIP (Global Infrastructure Partners) is still involved with London Gatwick and Edinburgh airports in the UK.

See: Paine Field: U.S. airport receives boost from major global investor

Around 600,000 passengers used the airport in 1H2019. Further statistics on traffic are not available, but from a height of 29 aircraft arrivals and departures daily there are now five – all operated by Alaska Airlines.

Seat capacity is barely above what it was in October 2020, and is just above a quarter of what it was in 2019.

Limited utilisation presently, but Paine Field has ‘first mover’ status; all its competitors are GA only

Utilisation at Paine Field is patchy, with only seven or eight of the 24 hours having departures or arrivals.

So the coronavirus pandemic has halted the high hopes for Paine Field, but it does have first mover status in its favour. There have been airlines operating there and there still is one. Moreover, it has modern infrastructure in place around which more could be built quickly.

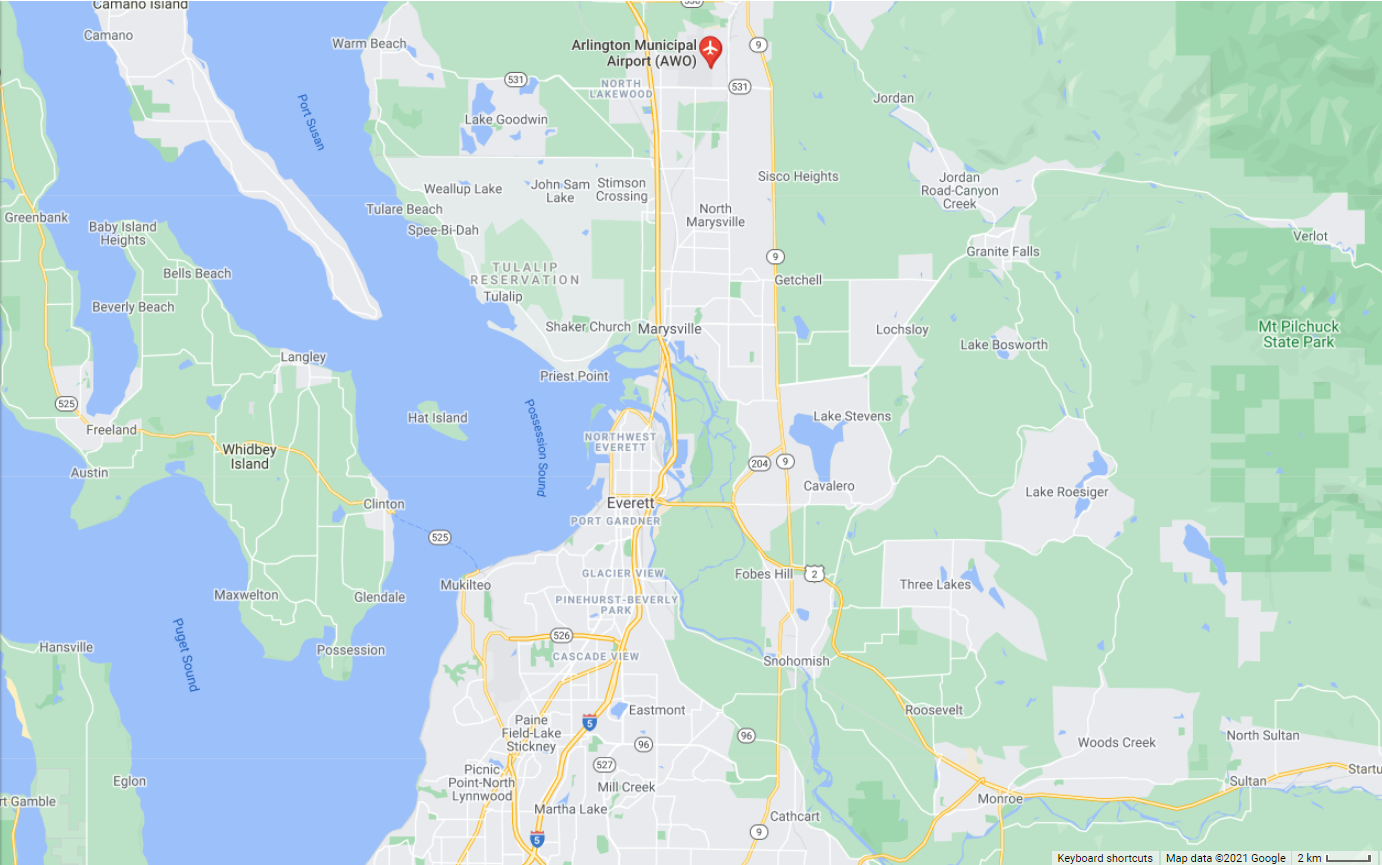

Of the other contenders: Arlington Municipal Airport (not to be confused with one of the same name in Texas) is to the north of Everett, a further 20km out of Seattle and (like Everett) close to Interstate 5. Owned and operated by the City of Arlington, it is purely a general aviation airport presently, while also supporting aviation-related industries.

Arlington has two runways, one of which is 1625m x 30m, which would be adequate for many commercial short haul aircraft, but otherwise any infrastructure development would be starting from scratch. In 2019 the city began lobbying for a 206m runway extension to support larger aircraft and anticipated growth.

One (apparent) advantage Arlington does have is that it was previously (in the 1990s) selected by the Puget Sound Regional Council as a candidate for expansion into a regional airport to relieve Seattle–Tacoma International Airport.

The council decided instead to construct a third runway at SEA-TAC in 1996, leaving Arlington to redevelop its airport for general aviation, along with a 50 hectare business park on the west side of the airport.

Location of Arlington Municipal Airport in Washington State

Source: Google Maps

Bremerton National Airport is also a general aviation facility, located in Kitsap County, Washington. Although only 20km from downtown Seattle, it has the disadvantage of being across the Puget Sound from the city and thereby not easily accessible, although it is more so from Tacoma. It has an 1830m x 46m runway.

Again, Bremerton was, in 2019, described as a potential candidate for expansion as part of Washington State's Department of Transportation effort to expand commercial airport space in the Puget Sound region. It was placed on the shortlist, along with Arlington Municipal Airport, Paine Field, Sanderson Field, Tacoma Narrows Airport, and South Lewis County Airport; in fact, all of the airports that have come up for consideration again now.

On April 29, 2021 a white paper was released detailing the benefits of each site.

While Bremerton National Airport was described as being able to "provide additional general aviation aircraft storage capacity and expand business aviation support", there were concerns about the distance between the airport and major interstates, including the travel time between counties.

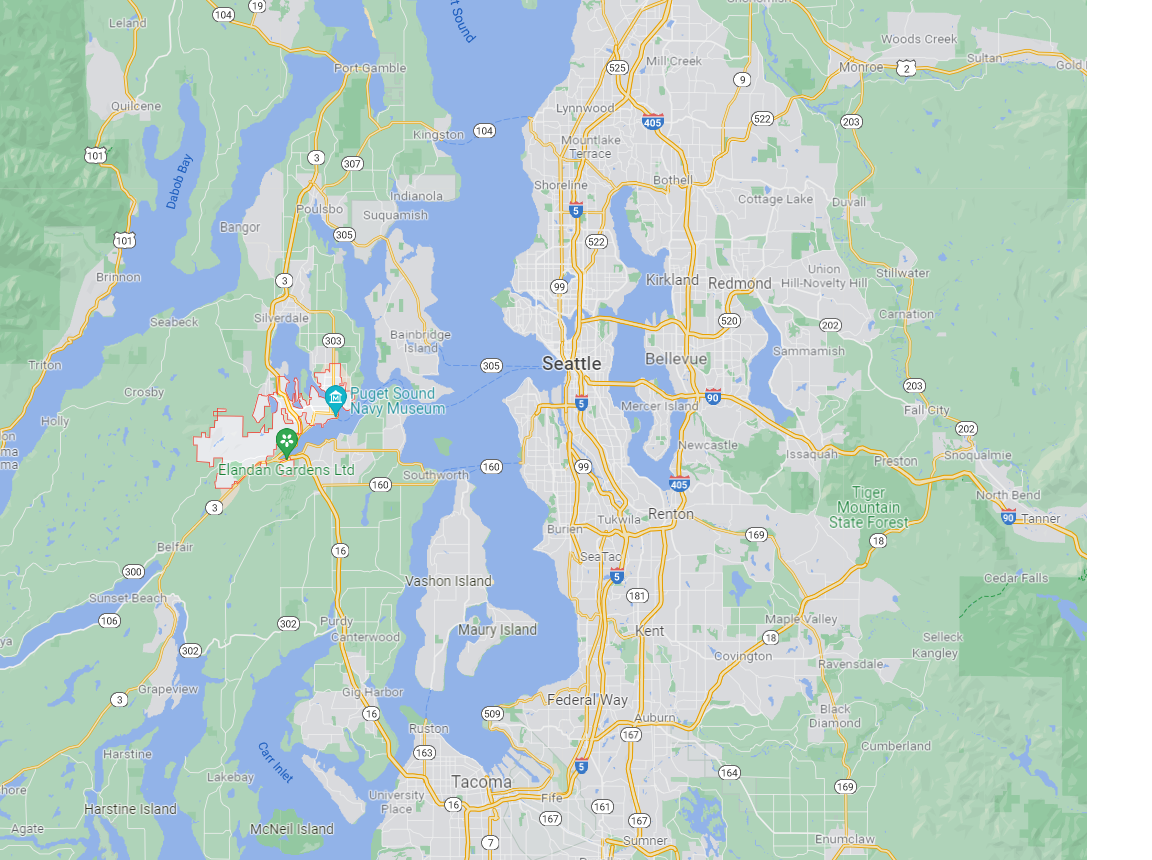

Location of Bremerton to Seattle and Tacoma

Source: Google Maps

South Lewis County Airport is, again, classified as a general aviation facility, county-owned and with a runway of 1365m x 46m, which is too small for most commercial operations.

This facility is situated to the south of Seattle (135km) and Tacoma, close to the town of Toledo but on the Interstate 5 highway and quite close to the Mount St Helens National Volcanic Monument to the 1980 eruption. It is not known to have been previously considered as the site of a new commercial airport.

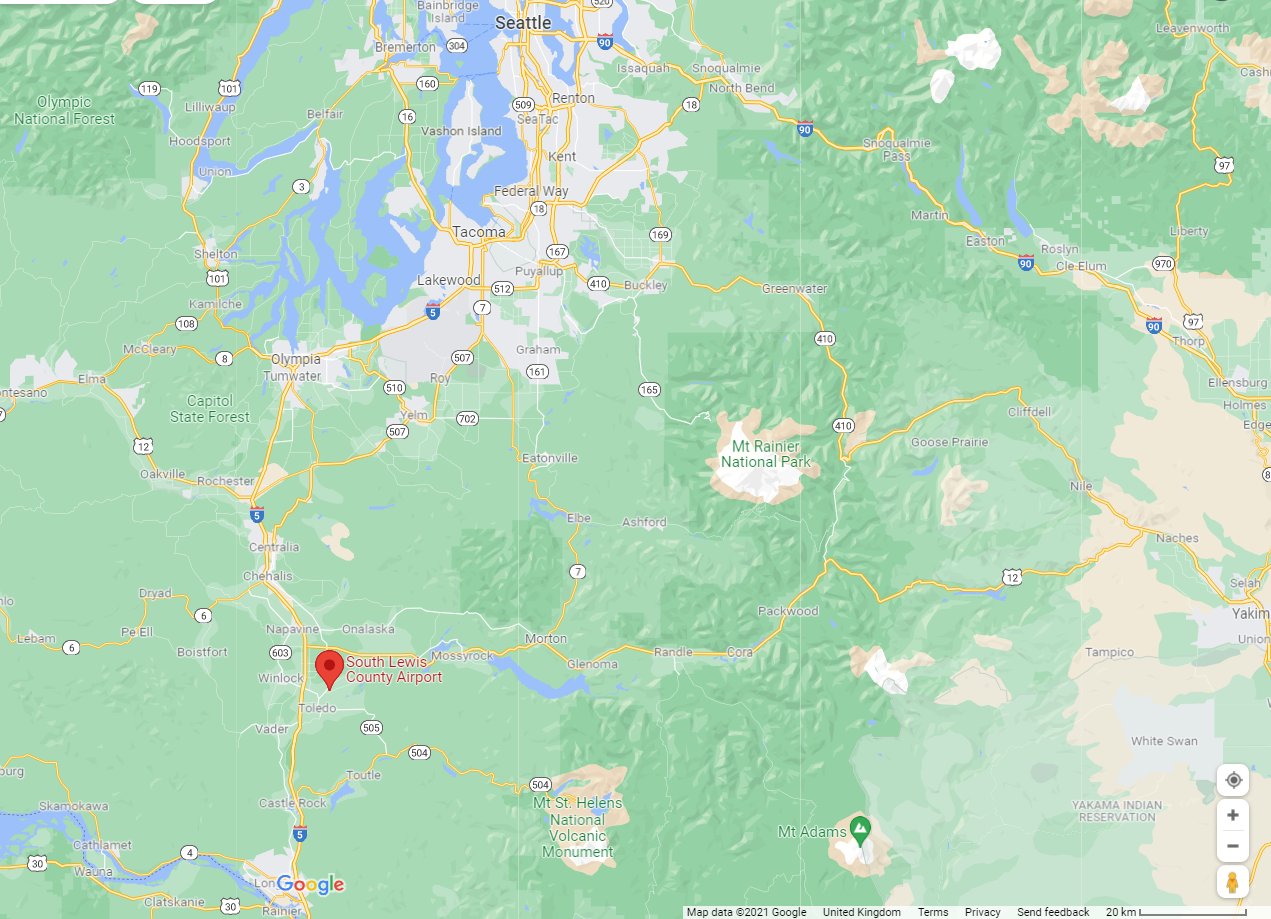

Location of South Lewis to Seattle and Tacoma

Source: Google Maps

Sanderson Field Airport is a public airport located in Shelton, a city in Mason County, Washington State. It is located just outside the City of Shelton corporate limits, and is owned and operated by the Port of Shelton. It is bordered on the east by US Highway 101.

The nearest sizeable city is Olympia and accessibility from Seattle would be difficult from close to 100km distant.

Again, there is no suggestion that this airport has figured in previous calculations.

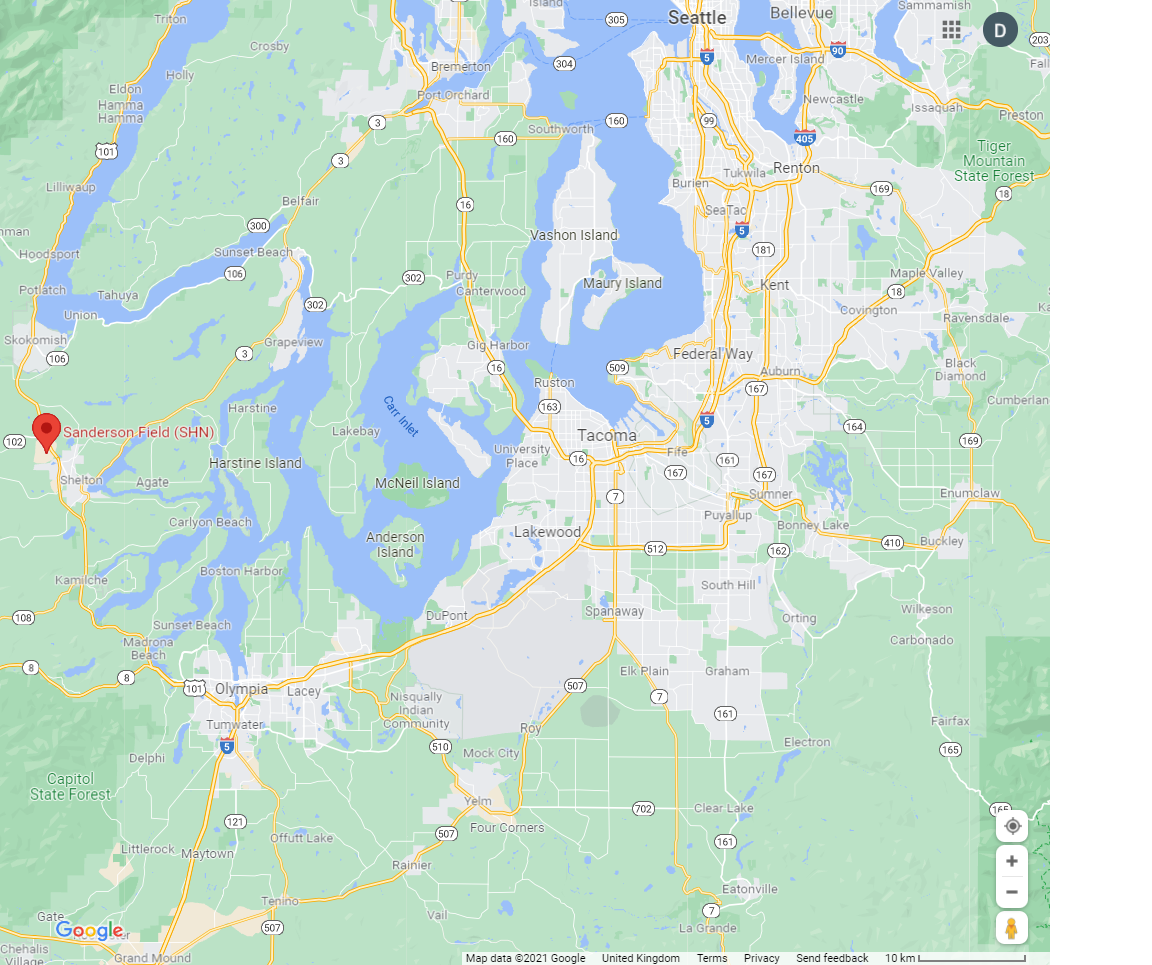

Location of Sanderson Field

Source: Google Maps

Tacoma Narrows Airport is a general aviation facility located eight km (five miles) west of the city of Tacoma, in Pierce County, Washington State. The airport is owned by Pierce County.

There are no commercial operations although there have been in the past, the most recent being in the 1970s. The airport has a 1525m runway.

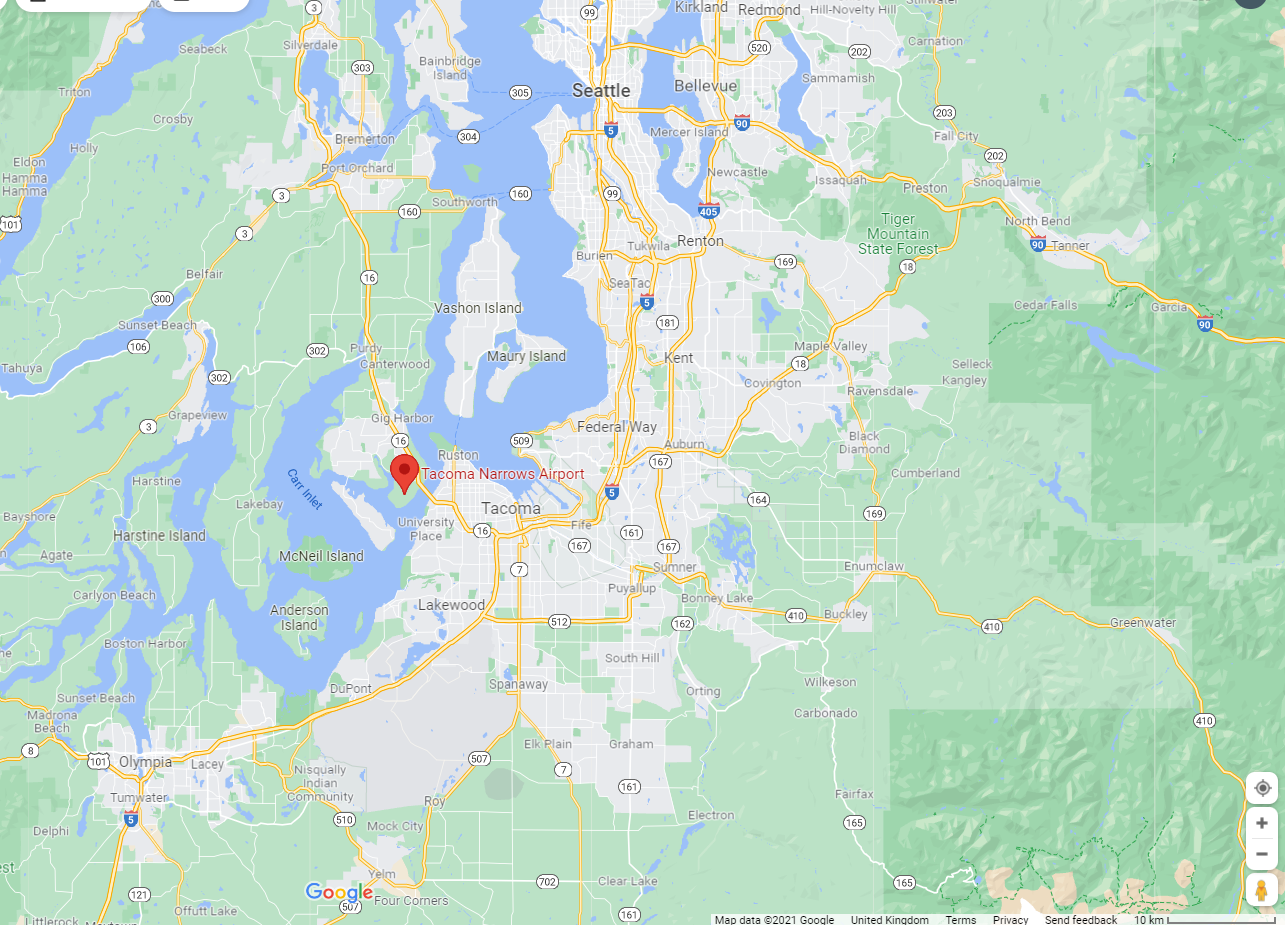

Location of Tacoma Narrows Airport

Source: Google Maps

Apart from at Everett Paine Field, it is evident that a great deal of construction work would be required to elevate all these airports into even the most basic commercial reliever airport, and such airports rarely remain at the ‘reliever’ level for long as any advantages they offer, be they in terms of cost or convenience, become available.

On the other hand, none of them is convenient to both Seattle and Tacoma, and some of them only specifically to one city. To be directly convenient to both they would have to be situated between the two cities and close to the main interstate highway which connects them – and that is exactly where Sea-Tac airport is.

The selection will inevitably be influenced by political and environmental considerations

The choice will probably be determined by which political parties and pressure groups are able to assert most influence and geo-economic factors such as population density, location of commercial properties and master urban development plans will come into play. Including environmental considerations.

As things stand, the location of Paine Field and the fact that there is so much infrastructure already in place, runway length, accessibility, commercial services already operating, the presence of Boeing and of experienced private sector managers mark it out as the favourite.

While the decision is being made, a long procedure which will drag on longer yet, the Sea-Tac airport is undergoing an expansion of its own and is expected to complete construction of a USD1 billion international arrivals facility by the end of 2021. The 450,000sqft site is expected to increase the number of international capable gates at the airport from 12 to 20, adding three international baggage claim carousels and increasing passenger capacity to 2600 passengers per hour.

According to the CAPA Airport Construction Database, USD2.7 billion in total is committed to infrastructure enhancements at the airport through to 2033, and the light rail line which connects the airport is also being extended.

Under similar circumstances airport expansion projects have been suspended during the pandemic, but there is no suggestion that will happen in Seattle or that the search for a suitable reliever airport will be curtailed or abandoned.

Atlanta debacle unlikely to be repeated

There is always the possibility of airline resistance to the development of any second airport for the region.

That is what happened at Atlanta almost 10 years ago. Delta, which dominates the busiest airport in the US (and the world until 2020) helped co-ordinate opposition to the opening up of the general aviation Gwinnett County Briscoe Field airport at Lawrenceville to the northeast of the city to commercial operations because it was reluctant to split its own operations between Atlanta Hartsfield Airport (to the south) and Briscoe Field, which it would have had to do to retain market share.

Gwinnett County Briscoe Field would be a handy airport for inhabitants of Atlanta’s richer northern suburbs, one of which, Buckhead, is actually trying to break away from Atlanta to become a city in its own right.

There are some similarities with the situation in Seattle, but no airline has the same degree of influence there as Delta has at Atlanta, apart from Alaska Airlines, which is already operating at Paine Field.

The developer at Gwinnett County would have been Propeller Investments, which will have learned much from that debacle.