Where travel agents earn, learn and save!

News / European aviation recovery reaches new high, but lags other regions

Europe's airlines continue to hold on to their peak summer schedules, with 3Q2021 projecting 73% of 2019 seat numbers

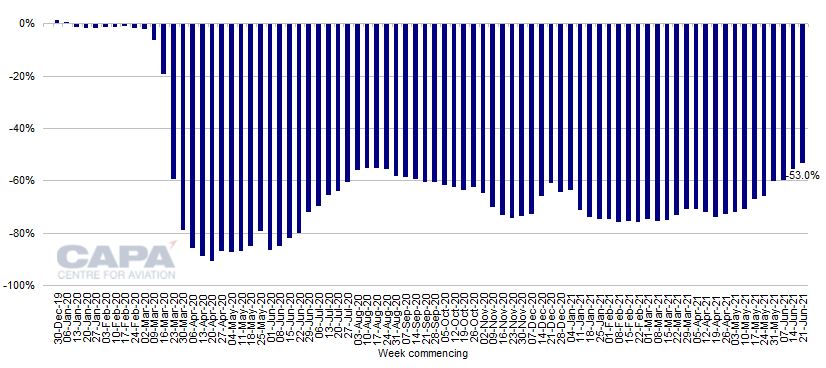

June 29 - European aviation has recovered both capacity and passenger numbers throughout 2Q2021. Seat capacity in Europe is 53.0% below 2019 in the week commencing June 21, 2021, compared with a reduction of 70.6% in the first week of the quarter. Europe is now closer to 2019 capacity than at any time since March 2020.

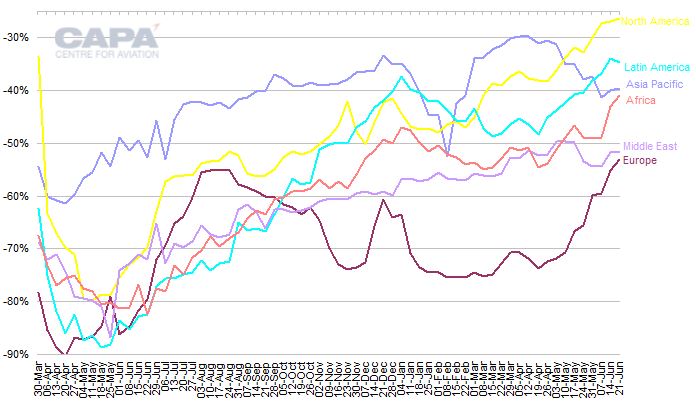

However, this result remains weaker than the other regions, even though the gap is narrowing.

Middle East seat capacity is down by 51.6% versus 2019, while Africa is down by 40.9%, Asia Pacific by 39.6%, Latin America by 34.7%, and North America by 26.3%.

Europe’s passenger traffic trend has also improved, although with a gap of approximately 8ppts behind capacity. In early June 2021 European airport traffic was 67% below 2019 levels (source: ACI Europe), but this compares with US traffic being just 28% below 2019 (source: US Transportation Security Administration).

Europe has higher vaccination rates than most regions apart from North America, but its reliance on international markets is weighing on its recovery. A better synchronized approach between states to reopening international travel in Europe could improve this.

Europe has 17.2 million seats vs 36.5 million in 2019 – down 53%

In the week commencing June 21, 2021, total European seat capacity is scheduled to be 17.2 million, according to OAG schedules and CAPA seat configurations.

This is 53.0% below the 36.5 million seats of the equivalent week of 2019. It is the 66th week of very heavy double digit percentage (more than 50%) declines in seats versus 2019.

This is 2.1ppts better than the 55.1% fall a week ago, and takes Europe back above the previous peak recovery week in mid August 2020, when seats were 54.9% below the equivalent week of 2019.

In absolute terms, the 17.2 million seats scheduled for this week is more than at any other time during the COVID-19 pandemic.

This week’s total seat capacity for Europe is split between 6.6 million domestic seats, versus 8.2 million in the equivalent week of 2019; and 10.6 million international seats, versus 28.3 million.

Europe’s domestic seats are down by 20.1% versus 2019, compared with last week’s -23.0%.

International seat capacity is down by 62.5% versus 2019, compared with last week’s -64.6%.

Europe: percentage change in weekly airline seat capacity vs equivalent week of 2019, December 30, 2019 to June 21, 2021

Europe has almost closed the gap with the next weakest region

Europe's 53.0% cut in seat numbers is now just 1.4ppts adrift of the next deepest, Middle East, which is down by 51.6% from 2019 seat capacity this week. This gap is the narrowest since December 2020.

Africa’s seat count is down by 40.9%, Asia Pacific’s by 39.6%, Latin America’s by 34.7%, and North America’s by 26.3%.

Europe, Africa and North America have taken upward steps in the trend of seats versus 2019 levels this week. Asia Pacific and Middle East have remained broadly level with last week, whereas Latin America has taken a small downward step.

Percentage change in passenger seat capacity vs 2019 by region, week of March 30, 2020 to week of June 21, 2021

Europe's airlines continue to hold on to their peak summer schedules

Now into the final full week of 2Q2021, scheduled capacity for Europe in the quarter is down by 66% from 2019 levels (i.e. at 34% of 2019 levels, compared with 27% for 1Q2021), according to data from OAG and CAPA.

Schedules for 3Q2021 have been trimmed by 2% since last week, with seat numbers for the quarter planned to be down by 27% versus 2019. However, projected 3Q capacity was modestly increased last week, and the current outlook has changed little over the past month.

With an ambitious 73% of 2019 seat capacity still scheduled for 3Q2021, Europe’s airlines continue to hold on to their peak summer schedules.

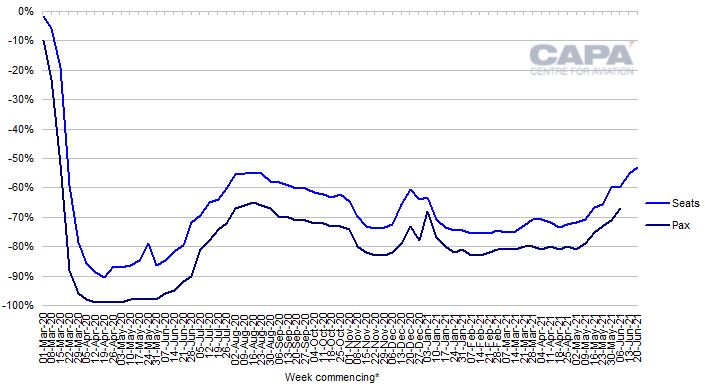

Europe's passenger trend is improving too, but is behind the capacity trend

The improving trend in European seat capacity as a percentage of 2019 over the past six weeks has been followed, with a lag, by passenger data.

According to preliminary data from ACI Europe covering 86% of European passenger traffic, passenger numbers were down by 67% versus 2019 in the week commencing June 6, 2021 (the most recent week for which data are available).

This was 8ppts below the seat trend (down 59% versus 2019 in the same week), but an improvement from -81% in the week commencing May 2, 2021.

Europe: percentage change in weekly seat capacity and passenger numbers vs 2019 levels, March 1, 2020 to June 20, 2021

Source: CAPA - Centre for Aviation, OAG, Airports Council International Europe (ACI Europe).

Europe's reliance on international markets continues to hold back its recovery

The improving trend in European passenger numbers is considerably weaker than the recovery in US traffic.

According to data from the US Transportation Security Administration on travel numbers through the agency’s checkpoints, traffic was down by only 28% versus 2019 in the week commencing June 6, 2021 (compared with ACI Europe’s -67%).

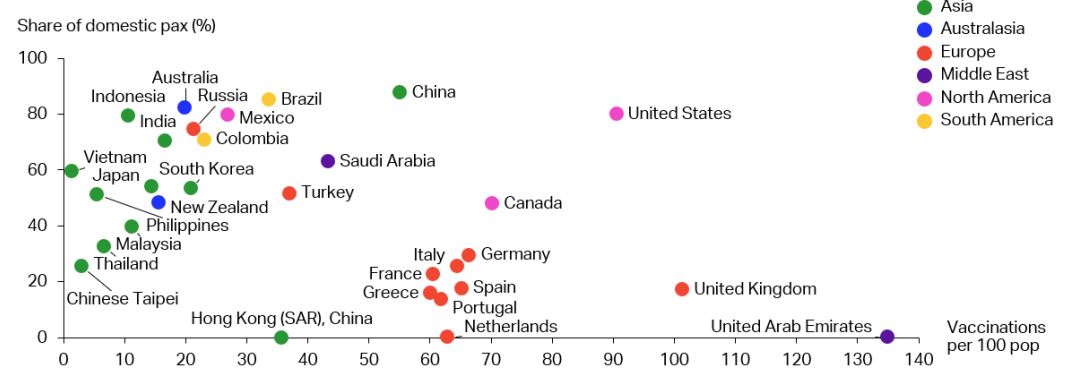

The relative weakness of the European passenger traffic recovery so far, by comparison with the much stronger US recovery, is explained to a high degree by the chart below from IATA.

Using data on the world’s top 30 countries by 2019 passenger numbers, the chart shows vaccinations per 100 people as of June 7, 2021 (horizontal access) and share of domestic passengers in total traffic (vertical axis).

Current* vaccination doses per 100 inhabitants, and share of domestic passengers in 2019

Data is for top 30 countries by 2019 airline passenger numbers.

Source: IATA Economics, using data from DDS, Our World in Data.

The US is the only large market that enjoys both a high vaccination rate and a large proportion of domestic passengers. Its airlines do not need to rely very much on the relaxation of international travel restrictions.

By contrast, most of the larger European markets have a very low share of domestic passengers and only a middling vaccination rate compared with other countries.

The UK has a higher vaccination rate than the US (and much higher than the rest of Europe), but a much smaller domestic market. European vaccination rates are higher than in Asia Pacific and South American countries.

However, European domestic markets are smaller and this factor is currently more significant in holding back Europe’s recovery. European airlines rely much more on international markets.

Moreover, those airlines rely significantly on international markets to destinations beyond Europe. According to IATA, 38% of EU passengers travelled outside the EU in 2019.

Europe lacks a coordinated approach to international travel restrictions

Although recent weekly traffic data are not available for all regions, the capacity data indicate that Europe continues to lag other regions, even if the gap is closing. This lag is in spite of Europe's higher vaccination rates compared with most regions apart from North America.

A more coordinated and flexible approach to international travel restrictions among European governments could help to convert Europe’s relatively good progress on vaccinations into a stronger aviation recovery.

More Travel News:

WTTC responds to call to reimpose quarantines on arriving British travellers across the EU

WTTC responds to the UK government’s update to the travel traffic light system

Warner Bros. Studio Tour Hollywood opens with expanded Central Perk Cafe and Friends boutique

Travel industry can boost recovery by addressing trust gaps in areas including price transparency and COVID-19 health and safety