Where travel agents earn, learn and save!

News / CAPA Live: EMEA aviation update, April 2021

Europe shows signs of preparing for the summer season

Europe shows signs of preparing for the summer season

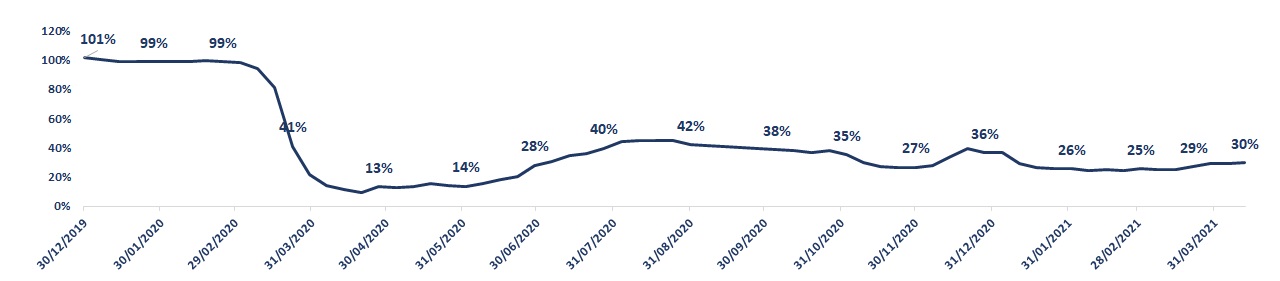

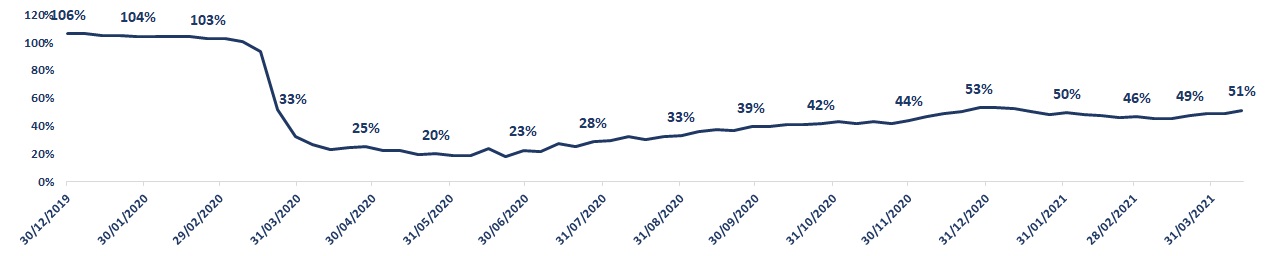

Europe: total capacity as a percentage of 2019 levels, December 30, 2019 to March 31, 2021

Despite Europe experiencing a huge third wave of COVID-19 infections, the continent is actually one of the best performing regions, from an air capacity perspective.

Capacity has risen 26.7ppts since March 2021 – but it’s important to remember that this was from a very low base.

Europe: ASK, total seat capacity and total cargo capacity, March 2021 vs April 2021

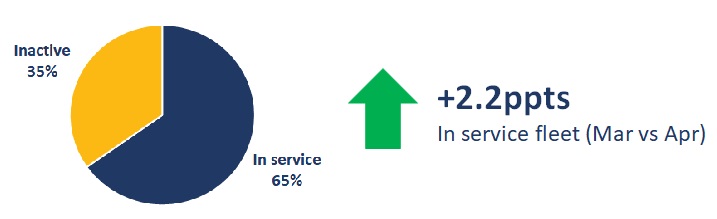

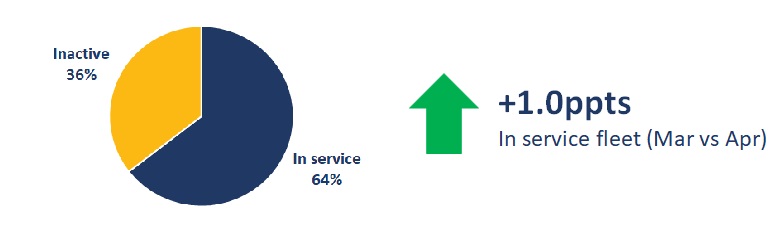

Europe: fleet in service, March 2021 vs April 2021

Middle East recovery continues into the spring

Middle East recovery continues into the spring

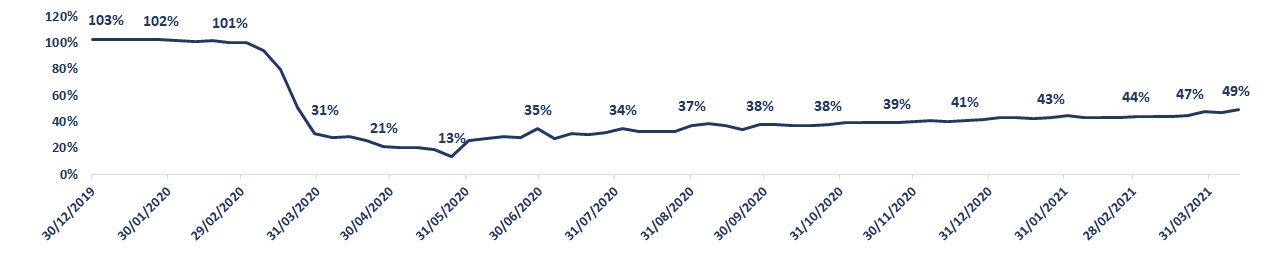

Middle East: total capacity as a percentage of 2019 levels, December 30, 2019 to March 31, 2021

The Middle East has had a good month also, with overall fleet in service rising 2.1%, adding 6.7% more capacity to the region’s network.

Middle East: ASK, total seat capacity and total cargo capacity, March 2021 vs April 2021

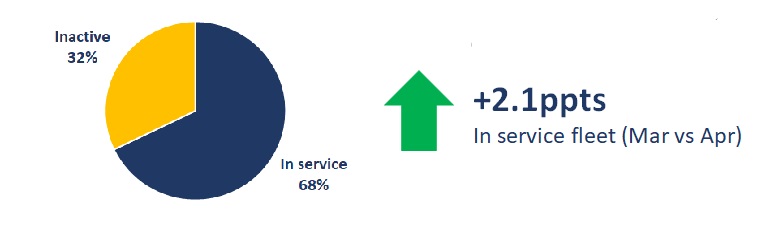

Middle East: fleet in service, March 2021 vs April 2021

Africa has turned the tide on months of negative data

Africa has turned the tide on months of negative data

Africa: total capacity as a percentage of 2019 levels, December 30, 2019 to March 31, 2021

Africa has an all green dashboard for the first time in several months, with growth in all metrics. Although fleet in service only rose slightly, capacity grew at an impressive rate as more routes reopened across the continent.

Africa: ASK, total seat capacity and total cargo capacity, March 2021 vs April 2021

Africa: fleet in service, Mach -2021 vs April 2021

EMEA: COVID-19 cases per country

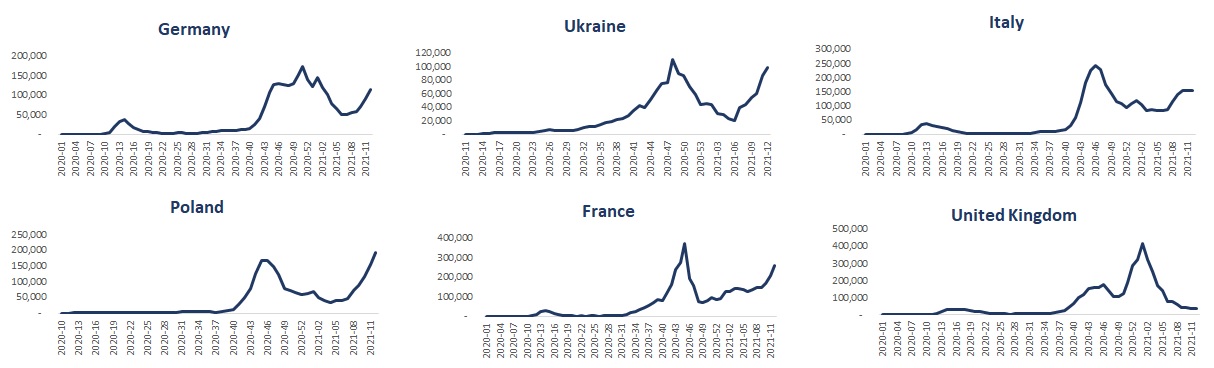

Europe has been the epicentre of the COVID-19 pandemic several times, with cases across the continent once again rising at an incredible rate.

Many countries are experiencing a new wave of COVID-19 infections, including Germany, Ukraine, Italy, and Poland, however it’s France where case numbers are now reaching near-record numbers. France has now become the worst-affected country by number of cases in Europe, overtaking Russia in recent weeks.

The UK, once badly affected, has reduced its new cases significantly and is coming out of one of the strictest lockdowns in the region, coupled with its fast and effective vaccination rollout.

EMEA: COVID-19 new weekly cases per country

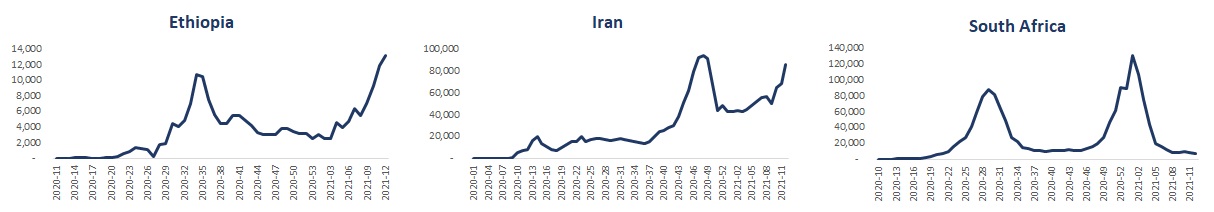

Elsewhere, in Ethiopia there has been a significant increase in new COVID-19 cases, as too in Iran, whereas South Africa has managed its latest wave well, and cases in that country have fallen sharply in recent weeks.

EMEA: COVID-19 new weekly cases per country, Ethiopia, Iran and South Africa compared

EMEA: COVID-19 vaccinations per country

EMEA: COVID-19 vaccinations per country

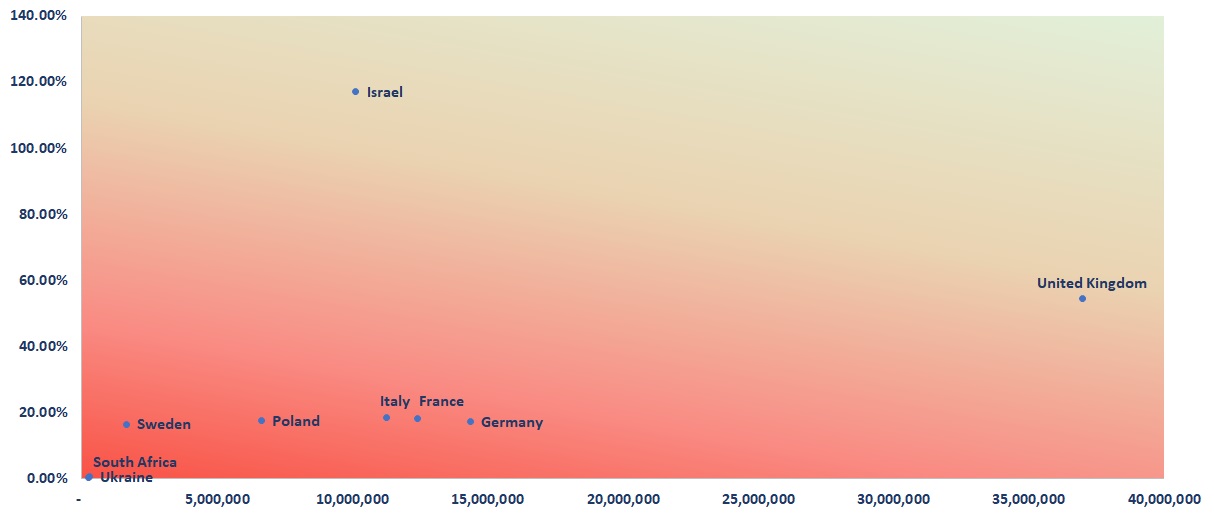

The graph below shows the major markets within the region and their current COVID-19 vaccination rates. Along the vertical axis is the percentage of the population that has currently received one or more doses, and along the horizontal axis is the total number of the population that has received a vaccine.

It’s been no secret that Europe has had a bumpy start to the vaccine rollout. As can be seen, most European countries are sat at about 19%. One noticeable outlier is the UK, having vaccinated over 56% of its population. It is argued that vaccinations are the single biggest driver of an aviation recovery, however until all countries are fully vaccinated, there will be disparities and challenges in the recovery.

The UK will likely reach herd immunity by September/October 2021, according to Bloomberg. Meanwhile, it’s reported that the European Union would need to triple its vaccination rate to achieve herd immunity by the end of 2021. This means that although some countries such as Israel, the US, the UK, Chile and the Seychelles will have achieved a high level of immunisation, until neighbouring countries do the same, widespread international travel will likely remain suppressed.

EMEA: COVID-19 vaccination rates, number vaccinated (one or more doses) and percentage of the country’s population

UK: a less optimistic view than previously projected, despite vaccine triumph

The UK has been one of the worst-affected countries in the world in terms of COVID-19 cases and overall deaths.

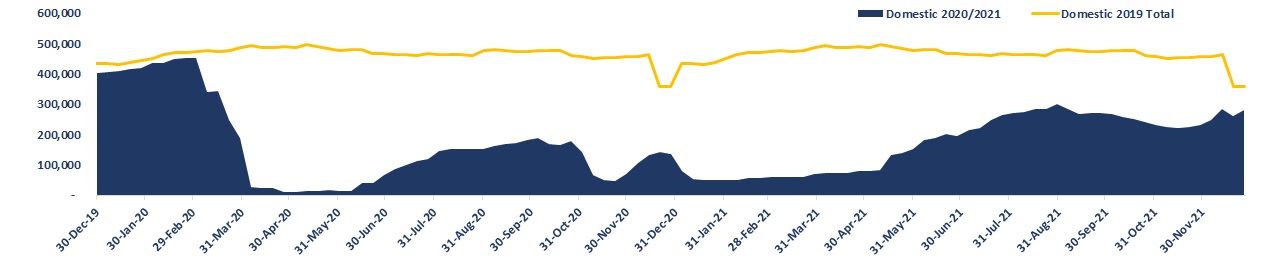

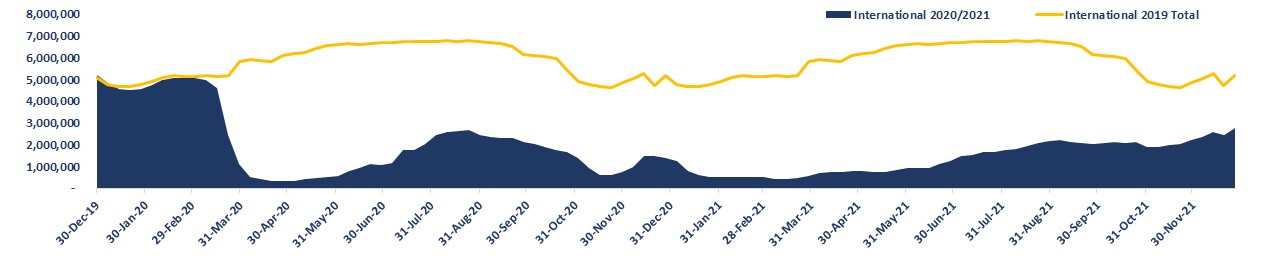

Despite a modest number of cases in the first outbreak in March 2020, the UK kept its borders open and relaxed almost all restrictions over the European summer of 2020, much as did many other European countries. This gave way to a catastrophic rise in cases as autumn arrived. In early Jan-2021 the UK went into yet another lockdown, which is only being relaxed now.

The only difference between the UK and many other European neighbours is that the vaccine rollout has been one of the most successful in the world; however, until neighbouring countries achieve a similar level of immunisation, international travel will likely remain supressed over the summer, which is something extremely concerning for the UK aviation industry.

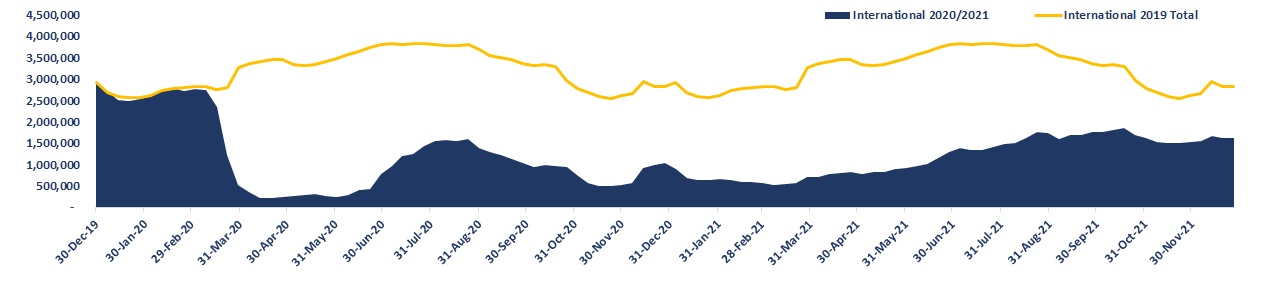

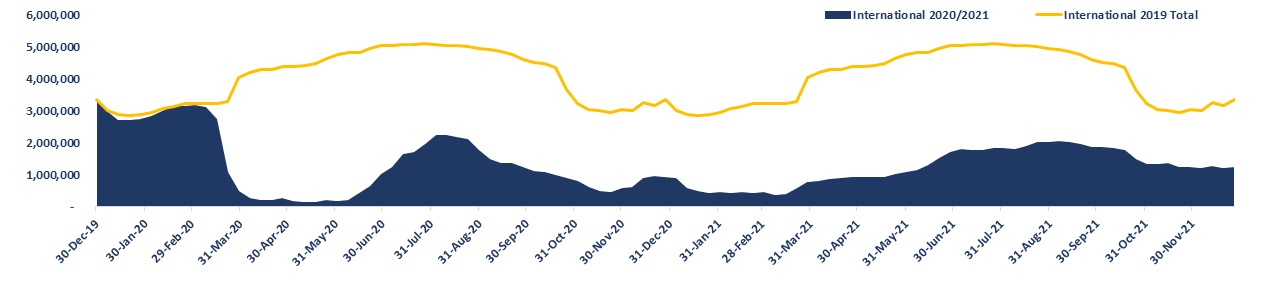

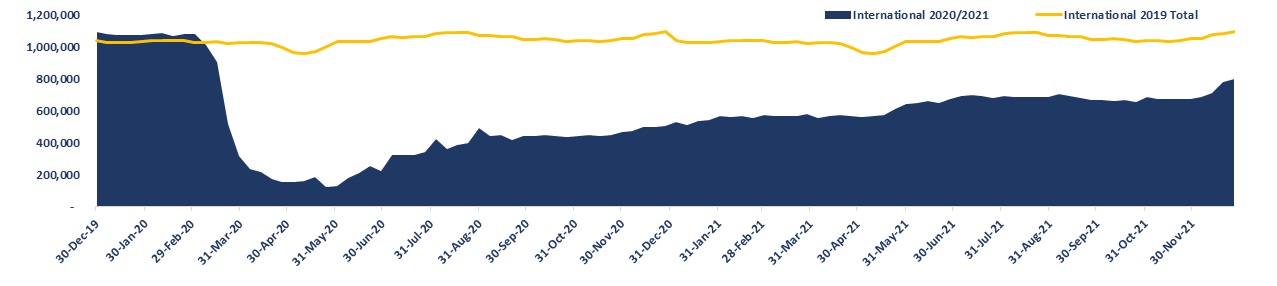

UK: domestic capacity, December 2019 to December 2021

UK: international capacity, December 2019 to December 2021

France: surprisingly robust capacity

In France, on the other hand, capacity has been slightly higher than in most other European neighbours.

Although international capacity fell dramatically in March 2020, the summer season offered a reprieve and it recovered to more than 50% of 2019 levels. Since then the country has had several waves of COVID-19, and this has led to capacity falling once again, but not by anywhere as much as it has in the UK.

France has not imposed such strict lockdowns in recent months and the vaccine rollout in the country has been slow. CAPA’s projections show an increase in domestic and international capacity throughout this year.

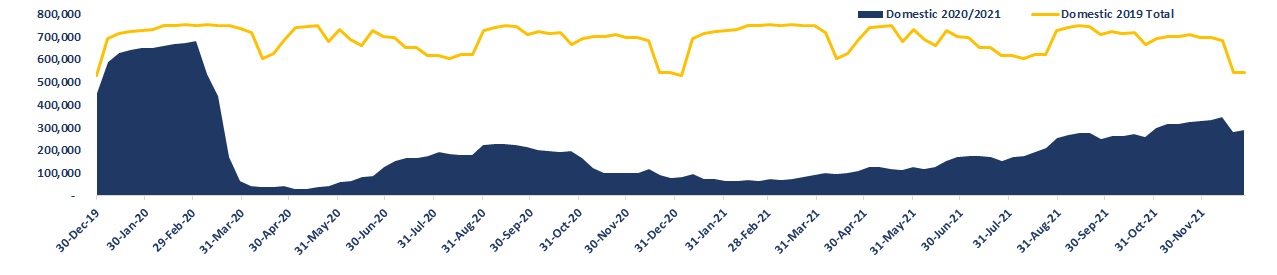

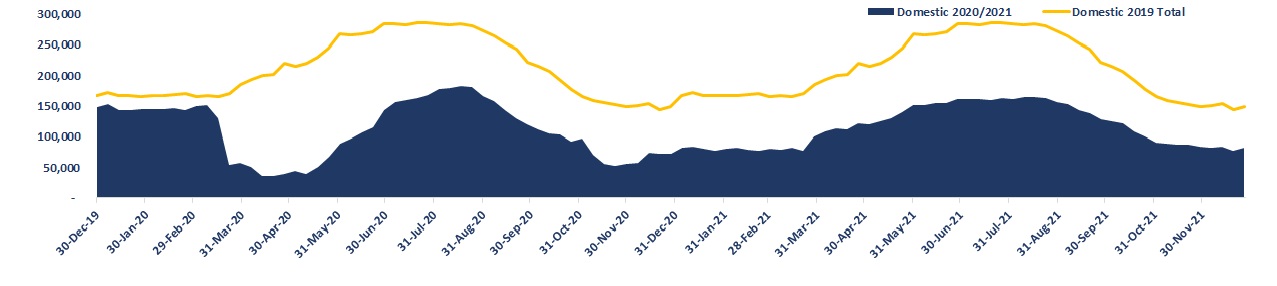

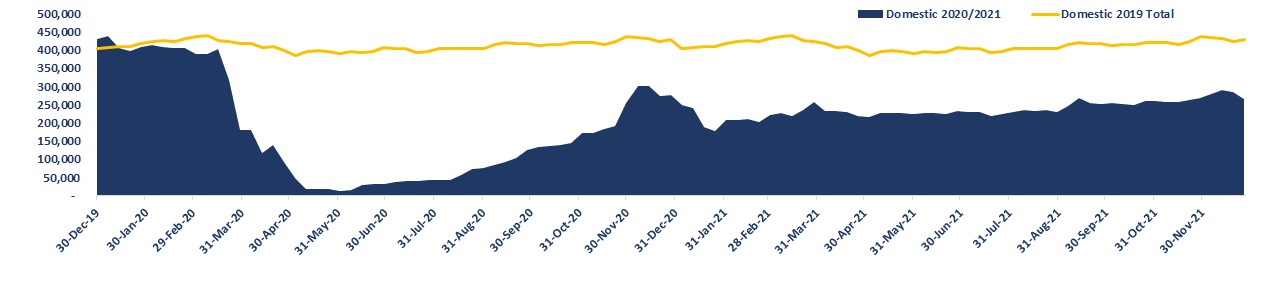

France: domestic capacity, December 2019 to December 2021

France: international capacity, December 2019 to December 2021

Germany: an uncertain summer season ahead

Germany: an uncertain summer season ahead

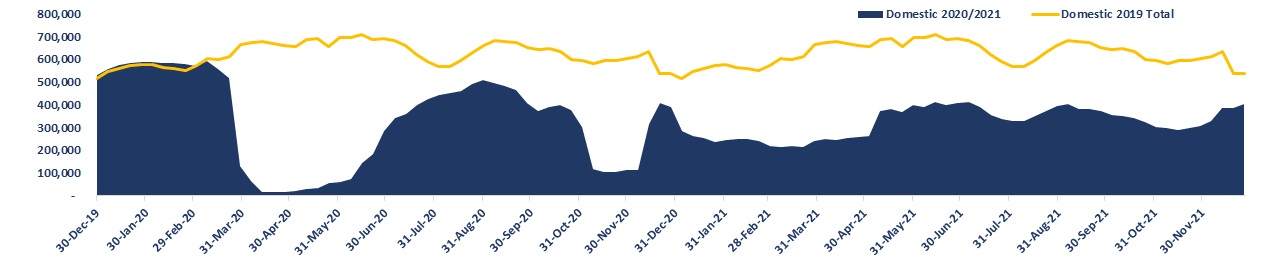

As in France and the UK, Germany’s capacity experienced a peak in the summer of last year.

Nevertheless, Germany has experienced a significant wave of COVID over the winter period and capacity has remained supressed.

However, interestingly, although cases are rising in the country, international capacity has begun to increase in recent weeks. Whether this increase continues will be seen in coming months, however CAPA’s projections show that capacity is not expected to rise as much as it did in the European summer of 2020.

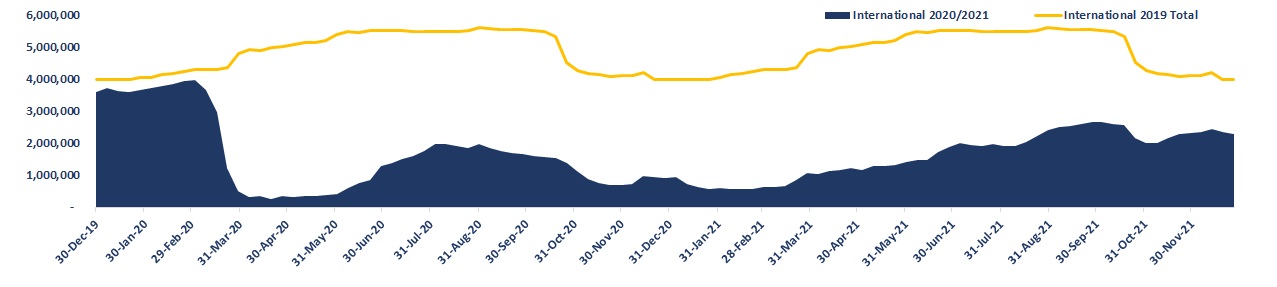

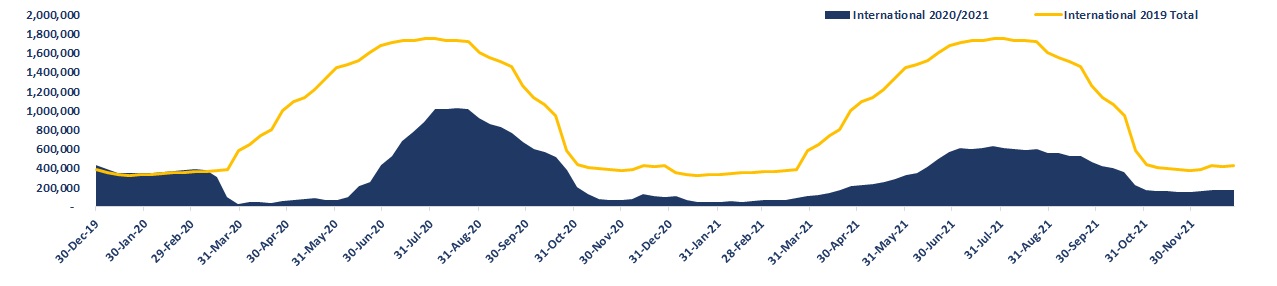

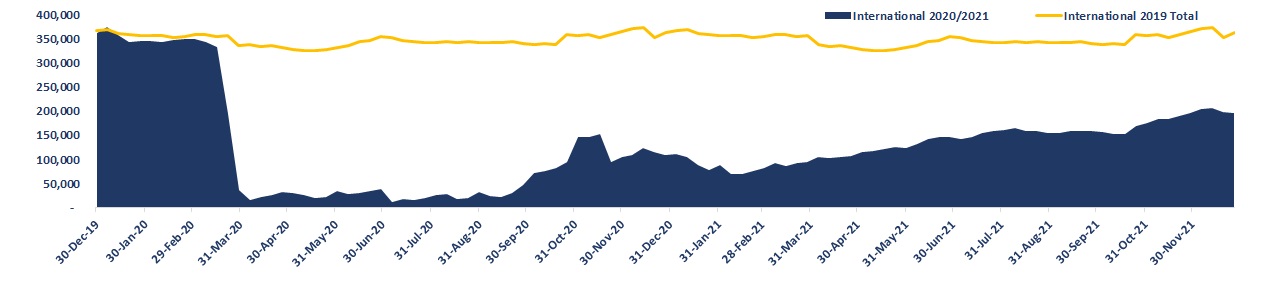

Germany: domestic capacity, December 2019 to December 2021

Germany: international capacity, December 2019 to December 2021

Spain: looking ahead to a quieter than normal summer season

Spain: looking ahead to a quieter than normal summer season

The European summer is fast approaching, and many Mediterranean nations usually use this period to prepare for the tourists from northern countries, but this year may be very different.

Spain usually welcomes the most tourists over this period, however with restrictions still in place in many European countries, projections show a much quieter European summer in 2021.

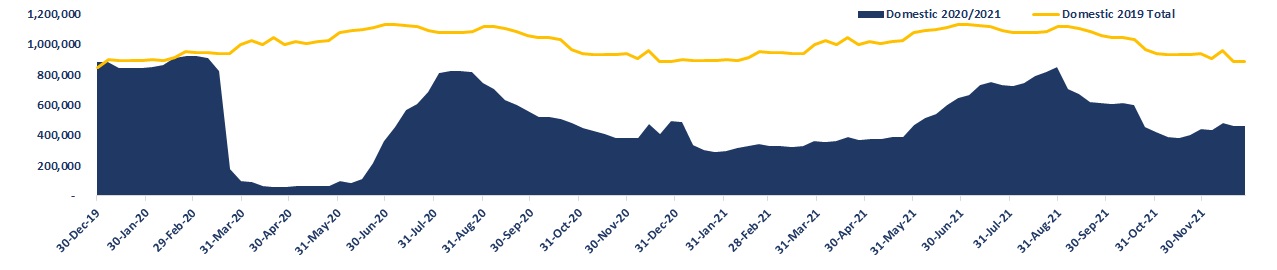

Spain: domestic capacity, December 2019 to December 2021

Spain: international capacity, December 2019 to December 2021

Greece: not projected to exceed 40% of 2019 capacity in summer 2021

Greece: not projected to exceed 40% of 2019 capacity in summer 2021

Greece is in a similar position to that of Spain, and projections for international seats don’t exceed 40% of 2019 levels over the summer. This is quite different from the projections late last year, where a full European reopening looked likely.

With the latest wave of COVID in Europe – it shows just how quickly things can changes.

Greece: domestic capacity, December 2019 to December 2021

Greece: international capacity, December 2019 to December 2021

UAE and Qatar: Middle East miracles in impressive international capacity recovery

UAE and Qatar: Middle East miracles in impressive international capacity recovery

In the Middle East the UAE has made a very impressive rebound, despite not having any domestic capacity to fall back on. Projections show a continued increase in capacity throughout the year.

The UAE’s largest airline, Emirates, recently announced that it intends to fly the A380 on many more services by the end of 2021. Currently the airline is only flying the aircraft type to a few high-density destinations, such as Cairo, London, and Amman.

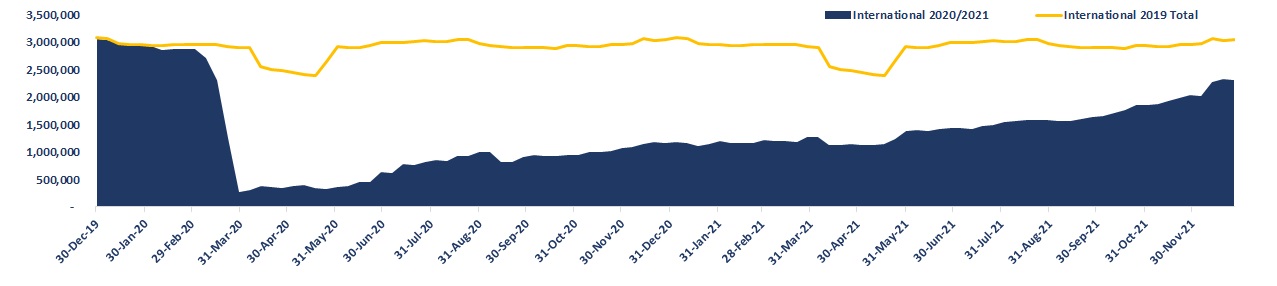

UAE: international capacity, December 2019 to December 2021

Qatar has had a similar 2020 and early 2021 to that of the UAE, with growth across its international network.

An interesting comparison is between the UAE and Qatar and Hong and Singapore.

Both Hong and Singapore have struggled without any domestic capacity to fall back on, whereas the two Middle Eastern countries have done remarkably well compared to their Asia Pacific counterparts, largely due to a more liberal approach to the management of the virus.

Qatar: international capacity, December 2019 to December 2021

South Africa: a fall in COVID cases, projecting an increase in capacity

South Africa: a fall in COVID cases, projecting an increase in capacity

In South Africa there has been an impressive drop in COVID cases in recent weeks, following a peak in early January 2021.

Despite a continuous rise in cases from November 2020 to January 2021, capacity actually grew at its fastest rate since the beginning of the coronavirus pandemic.

The projections for South Africa are heavily reliant on other African countries opening their borders, but as can be seen, a definite increase in capacity is expected.

South Africa: domestic capacity, December 2019 to December 2021

South Africa: international capacity, December 2019 to December 2021

More Travel News:

CAPA Live: Americas aviation update, April 2021

IATA: Reduced losses but continued pain in 2021

Alaska Airlines commits to carbon, waste and water goals for 2025, announces path to net zero by 2040

American travelers getting vaccinated rapidly