Where travel agents earn, learn and save!

News / Paris Olympics puts dent in Air Canada sales as some travellers avoid France

Transatlantic ticket sales drop as French and German travelers stay in Europe for Olympics and Euro 2024

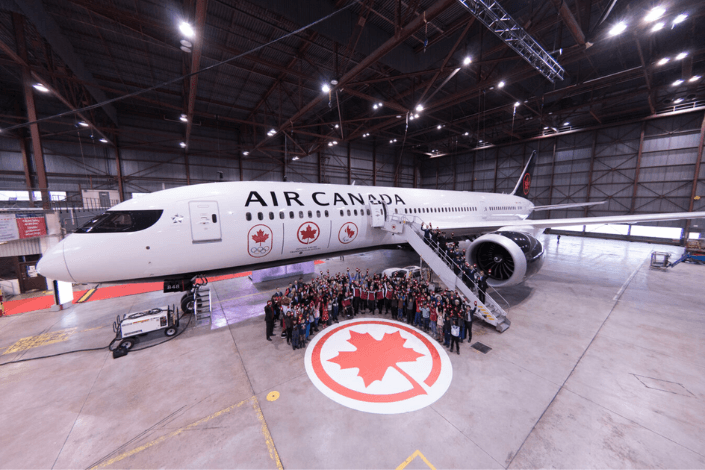

Air Canada may be the official carrier of Team Canada, but that didn’t stop the Paris Olympics from hobbling its summer sales.

Despite Canadians’ continued thirst for Mediterranean getaways, the airline’s transatlantic ticket proceeds suffered in its latest quarter as travellers from France and Germany opted to stay on the Continent to soak up the Olympic Games as well as Euro 2024.

The distracting athletics along with a glut of Atlantic flights from competitors helped prompt Air Canada to cut its capacity for trips across the pond, Galardo said.

While the Olympics are typically a tourism boon, many vacationers opted to steer clear of the City of Light, with parts of central Paris closed off for the duration of the games.

The weaker demand contributed to Air Canada’s 51 per cent year-over-year dive in profit last quarter — even while revenues rose.

Higher capacity and strong demand for international flights drove year-over-year revenue growth of two per cent to $5.52 billion in the quarter ended June 30. But revenue-per-seat figures dropped compared with the year before, when soaring post-pandemic demand and lower capacity across the industry made for fuller planes, higher fares and wider profit margins.

As a result, net income in Air Canada’s second quarter fell to $410 million from $838 million a year earlier.

Operating expenses that stood nine per cent above last year’s also helped account for the plunge, as the cost of jet fuel and labour rose, chief financial officer John Di Bert said.

Despite ongoing growth, Air Canada’s post-COVID rebound remains incomplete four and a half years after borders closed and lockdowns began.

Air Canada’s adjusted earnings notched slightly lower last quarter than in the same period five years earlier. The size of the carrier’s fleet is also smaller with 356 planes as of June 30, compared with 400 in the second quarter of 2019, although many of the scrapped aircraft were smaller, older and less efficient.

Air Canada shares slid 1.39 per cent to close at $14.93 on Wednesday, a closing price not seen since October 2020 — aside from last Friday — to cap off a 19 per cent decrease since the start of the year.

Earlier this year, executives said corporate travel, which is more lucrative for airlines than leisure traffic, would help fuel profits in 2024, even as pandemic habits of video conferencing and remote work proved tough to shake.

As rivals flocked to transatlantic routes, Air Canada dialled down its service there and ramped up Pacific flight volumes by a third. Two new routes — Toronto to Seoul, South Korea, and Montreal to Osaka, Japan — did “exceedingly well.

However, hurdles in the Pacific remain. They include China’s tight restrictions on tour group visits to Canada and a Russian airspace ban that forces Canadian carriers to take a longer route to Asia, adding significant fuel and labour costs.

The airline plans to pursue a “measured approach” to expansion, he added. It had only two more planes in its fleet last quarter than the year before. But it also locked down leases on eight Boeing 737 Max 8s, set to hit the tarmac next summer.

On an adjusted basis, the Montreal-based company earned 98 cents per diluted share, down from an adjusted profit of $1.85 per diluted share in the same quarter a year ago. The result beat analysts’ recent expectations of 92 cents per diluted share.

But it also came after Air Canada lowered its 2024 financial forecast in late July, saying its planes have not been as full as anticipated due in part to tough competition in international markets.

In its outlook Wednesday, the airline said it plans to increase its flight capacity in the third quarter by between four and 4.5 per cent compared with the same quarter in 2023.

Source: Travelweek